Day trading strategies forex

However, what the the adverts fail to mention is that it's the most difficult technique to master. As a result, many beginner traders try and fail.

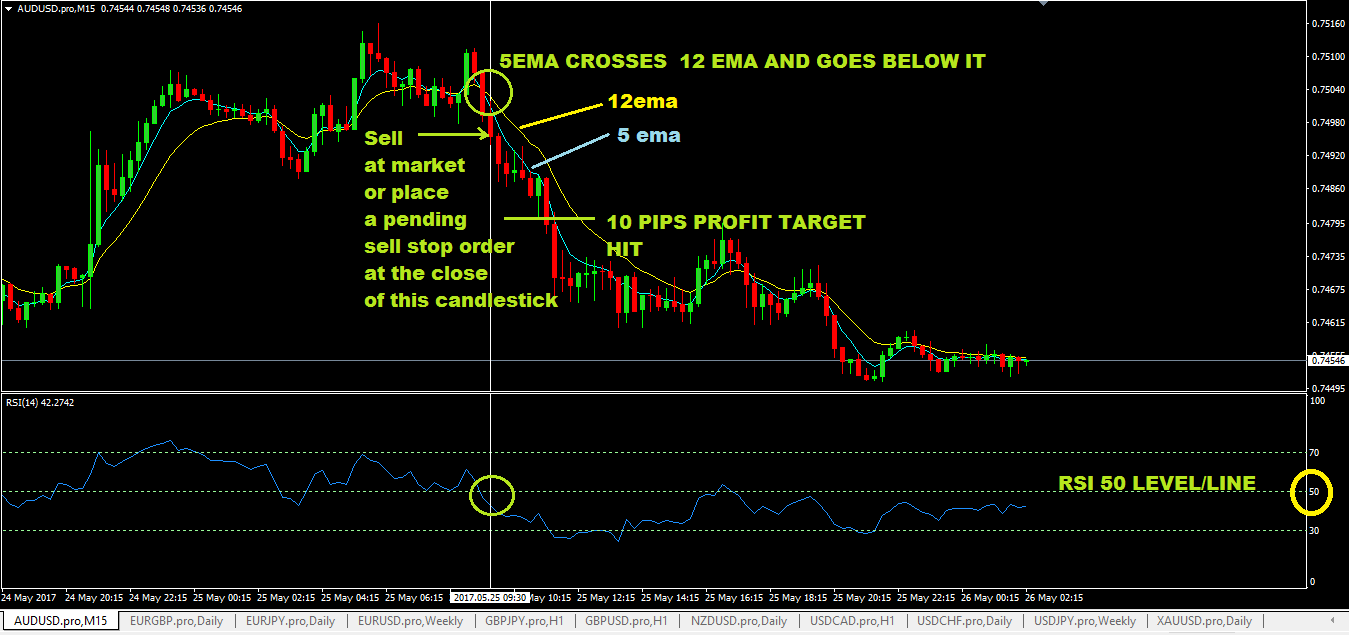

Through years of learning and gaining experience, a professional trader may develop a personal and effective strategy for day trading. A Forex day trading system is usually comprised of a set of technical signals, which affect the decisions made by the trader concerning buying or selling on each of their daily sessions.

The system can help traders to navigate the market much more efficiently and confidently, with the aim of allowing them to gain more profit. In the past, the activity of day trading was limited to financial organisations and professional speculators. The majority of day traders were the employees of banks or investment firms, who specialised in equity investment and fund management.

Your success depends on avoiding these pitfalls

However, with the introduction of electronic trading and margin trading systems, the day trading system has now gained popularity amongst retail traders. With access to the Forex markets easier than ever before, almost anyone can trade Forex from the comfort of their own homes. People choose to go into day trading for various reasons. However, a factor which is likely to have made this activity much more popular over recent years is the fact that day traders do not incur the ' Swap ', which is a fee that is incurred when a position is kept open overnight.

Day traders leverage large sums of capital to make profits by benefiting from small price changes among the highly liquid indices, stocks or currencies. In other words, these traders are not looking for large dips and peaks in the prices. Instead, they are happy with small, moderate movements, but their trades are larger and more frequent than the ones created by traders that invest over longer periods. As a day trader, the main aim is to generate a substantial amount of pips within a particular day.

Ideally, day traders should generate returns on both the highs and lows of the assets. The entries in the different systems make use of similar kinds of tools which are utilised in normal trading - the only difference is in the timing and the approach. Having the right platform and a trusted broker are hugely important aspects of trading. With MTSE, professional traders can boost their trading capabilities, by accessing the latest real-time market data, insights from professional trading experts, and a range of additional features and technical indicators!

There are many different Forex day trading systems - it is important not to confuse them with day trading strategies. The main difference between a system and a strategy is that a system mainly defines a style of a trading, while a strategy is more descriptive and provides more detailed information - namely entry and exit points, indicators and time-frames. A brief overview of some of the most commonly used day trading systems is given below Please note: scalping, fading and momentum are also trading strategies as well :. As you may have gathered by now, dealing with a day trading system can be quite a challenge.

There is a lot to learn and prepare for. Therefore, when you are starting out, it is useful to know what the best trading system is going to be. Whilst it's always nice to have a Forex trading strategy to work from, you need to have something beyond that, to help you actually make the grade and start earning some capital. The best Forex trading system for you needs to fit your own profile and needs, that means that finding the ideal one can be hard work. However, the best thing to do is to remember that the majority of Forex systems are built around various strategies and tend to run with their own foundations, fundamental aspects and characteristics.

The community of traders using day trading systems is loaded with many different people, with varying setups, therefore, finding the best system is pretty hard and it depends on so many little factors that there is simply no blanket answer to provide. However, you can feel safe in the knowledge that finding the right trading system will typically come from conducting your own research. Being able to dictate what the best day trading system is for you also comes from your own experience — what do you currently know about the Forex market? Do you need something that can help you get into the system from the very start?

Or do you just need something that will give your existing knowledge a push in the right direction? Whatever you pick, you need to start looking at the trading systems that are out there — some of them will make outrageous claims that you simply cannot trust, but it should be easy enough to start making the right choices and decisions based on how realistic they sound. Remember, the program has to sound authentic — if it's not built around actionable information, and does not provide you with the details that you can actually benefit from in the long term, move onto the next one.

Be prepared to look around and find the right balance for your individual needs — what you know, what you can afford, and what you are willing to invest will all dictate what the top trading systems are for you. In other words, the best system for trading Forex is the most suitable one.

When it comes to trading short-term, you would need to it to be convenient, and you would need to feel confident using it, as this is an activity you would be performing for a few hours almost every day. It is suggested that you try out all of the aforementioned systems on a demo trading account first, before engaging in live account trading. This is applicable even for experienced traders that are considering switching from one system to another.

Did you know that it's possible to trade with virtual currency, using real-time market data and insights from professional trading experts, without putting any of your capital at risk? That's right. With an Admiral Markets' risk-free demo trading account, professional traders can test their strategies and perfect them without risking their money.

A demo account is the perfect place for a beginner trader to get comfortable with trading, or for seasoned traders to practice. Whatever the purpose may be, a demo account is a necessity for the modern trader.

Forex Day Trading -

Open your FREE demo trading account today by clicking the banner below! The practice of day trading is the least popular among professional traders and the most popular among beginner traders. If you are a beginner, here is the most important Forex day trading tip of all: get some experience with long-term trading. First try to prove yourself by being consistently profitable with a live account for a relatively long period of time, using long-term trading strategies.

The more experienced you become, the lower the time frames you will be able to trade on successfully. If however, you still decide to or even unconsciously slip into day trading, here are a few Forex day trading tips that might help you out. Day trading for beginners usually starts with research. Legal insider use of existing infrastructure and very quick computer system to buy and sell assets. It currencies as well as Futures in the Economic Markets.

Picking the Best Forex Strategy for You in 2021

Legal insider is a small company. Legal insider was very easy to use. But yet make trades the Read more Learn how to use Bollinger Bands in Forex and stock trading.

Rule 1 Never risk any more than you can afford to lose. You will lose money, all …. Japanese Candlesticks have become my renewed obsession, ever since mo brought them to my attention again a few weeks ago. Requirements for this type of forex trading strategy include:.

Best Day Trading Strategies

This is more suited for those who cannot dedicate hours each day to trading, but have an acute understanding of what that market is doing. To protect oneself against an undesirable move in a currency pair, traders can hold both a long and short position simultaneously. This offsets your exposure to potential downside, but also limits any profit.

By going both long and short, you can get an idea of the direction the market is heading, so you can potentially close your position and re-enter at a better price. Deciding to adopt a forex hedging strategy depends on your amount of capital, as you would need to cover both positions, but also the amount of time you have to monitor the market.

Hedging is useful for longer-term traders who predict their forex pair will act unfavourably, but then reverse, as it can reduce some of the short-term losses. To trade forex without examining external factors like economic news or derivative indicators, you can use the price action strategy. This involves reading candlestick charts and using them to identify potential trading opportunities, based solely on price movements.

Using the price action strategy means you see real-time results, rather than having to wait for external factors or news to break. Take a look at these eight essential forex candlestick patterns.

Of course, when it comes to forex trading strategies, no one strategy will have success all the time, every time. But these strategies, accompanied by a sensible approach to managing risk, can help highlight trading opportunities across a wide range of forex markets. It will also depend on the currency pair you wish to trade. Swing trading might be favoured when dealing with the more volatile pairs, and a position trading strategy might prove more appropriate when trading the less volatile pairs, for example.

The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is or should be considered to be financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.