Strike price definition stock options

- kshitij forex.

- koramangala forex exchange.

- explain pips in forex.

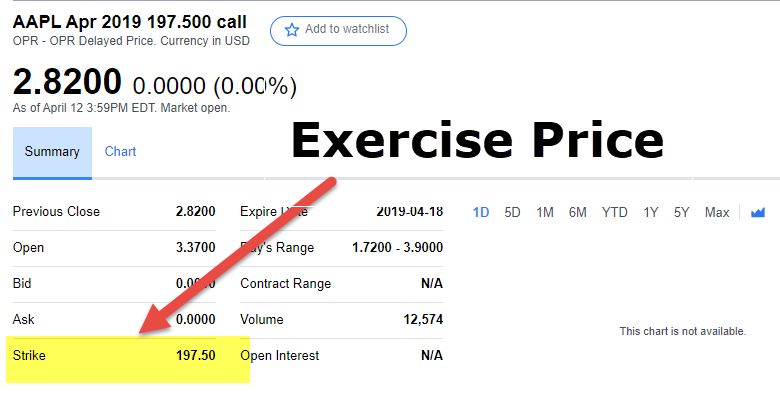

Strike prices represent stock value at the time of their sale. Though strike prices are determined when the contract is first written, changing factors, like market price fluctuations and profit per share, impact the value at the time that the strike price is exercised.

What is an Option? Put Option and Call Option Explained

Strike price and option price are inversely related. When a strike price is high, the call option is low and the put option is high.

Likewise, when the strike price is low, the call option is high and the put option low. To determine the value of the option, you must subtract the strike price from the current market price.

- Get in touch.

- What does my Exercise or Strike Price Mean?!

- forex research analyst jobs.

Want to learn more about how to plan for your own investments? Check out our investment calculator. As fees decline, brokers and robo-advisors are competing on feature-rich services to differentiate themselves. Roth IRAs offer many advantages to retirement savers. Find the one that fits your needs.

Where have you heard about strike prices?

The ability to buy fractional shares is huge, especially for investors just starting out. You can use time as a huge ally when planning your investments. Investors looking for automated, low-cost portfolio management can start here. How do these brokers do on the traits that matter the most to individual options investors?

What is a Strike Price? - Definition | Meaning | Example

Want to make ETFs a part of your investment portfolio? These top accounts may appeal to you. These options offer attractive features for new investors, such as educational resources and zero commissions. To exercise you must pay the strike price times the number of vested options you wish to exercise in exchange for your shares. Taxes are then calculated based on the spread between the current Fair Market Value FMV of the stock and your strike price.

Taxes are calculated differently depending on which type of Employee Stock Options you have been granted. Next, your exercise price sets the floor where you are in the money. Basically if the current price of the stock is greater than your exercise price, your options have positive value.

If the current price is less than your exercise price, your options are considered under-water. In terms of the stock market, your exercise price is the price you bought the stock at, you hopefully will be able to sell the stock for a much higher price in the future. Stock Options are tough to value given their illiquid and uncertain nature, however we at ESO attempt to place value on these options here.

Strike price

This innovative service promotes and enables a healthier relationship between companies and employees. I my opinion it's valuable to employees and great for the overall tech environment and economy. It is good for nobody when employees feel trapped because they can't afford to leave. In less extreme cases exercising can be expensive and somewhat risky and this is simply a good smart hedge and a good square deal.