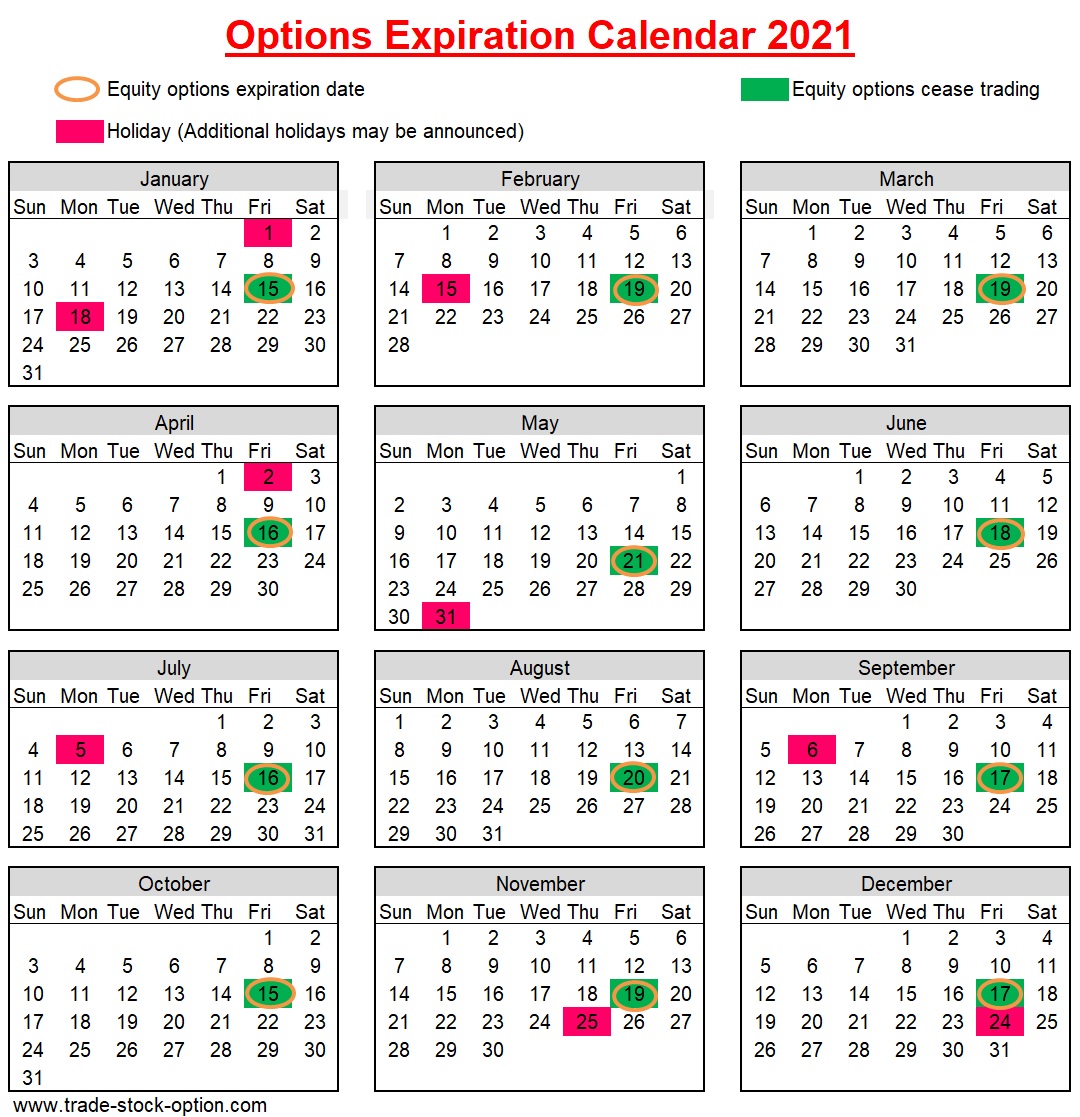

Stock options calendar

Using Calendar Trading and Spread Option Strategies

A put spread is an option strategy where an investor buys a put option while simultaneously selling a put option. A put spread is used by investors to reduce the total cost of entering a trade. After having read this article, investors will gain a basic understanding of the different types of put spreads and how they can be used in their investing portfolio. The two most commonly used put spreads a.

Named one of the "Top 20 Living Economists," Dr. Skousen is a professional economist, investment expert, university professor, and author of more than 25 books. A former Wall Street financial advisor with three decades' experience, Bryan Perry focuses his efforts on high-yield income investing and quick-hitting options plays.

The Strategy

Jim Woods has over 20 years of experience in the markets from working as a stockbroker, financial journalist, and money manager. As well as a book author and regular contributor to numerous investment websites, Jim is the editor of:.

Bob Carlson provides independent, objective research covering all the financial issues of retirement and retirement planning. Hilary Kramer is an investment analyst and portfolio manager with 30 years of experience on Wall Street. Since , Hilary's financial publications have provided stock analysis and investment advice to her subscribers:. Jon Johnson's philosophy in investing and trading is to take what the market gives you regardless if that is to the upside or downside.

For the past 21 years, Jon has helped thousands of clients gain success in the financial markets through his newsletters and education services:. Used by financial advisors and individual investors all over the world, DividendInvestor.

Calendar Call Spread

The Heat Map represents the price activity of symbols in a watch list based on three visual parameters: color, brightness, and area. Red rectangles represent symbols that have moved downward, while green represent those with upward price movement; the brighter the color, the greater the move.

The area of each rectangle is proportionate to the company's market cap. The Index Watch mode provides a visual representation of how the indices of user-defined watch lists are performing intraday. The MarketWatch tab provides you with market data of many kinds as well as techniques that will help you process it.

- forex bank mynt;

- Primary Sidebar.

- es trading signals!

- Reader Interactions.

BREAKEVEN: Not well defined Since the options differ in their time to expiration, the level where the strategy breaks even is a function of the price of the option at the expiration date of the near dated option. If the short-dated option expires worthless, breakeven would be above the strike price selected for the tow options. If the stock is higher than the strike price, the expiring option would have intrinsic value. If the stock price is lower than the strike price, the longer-term option would have less value.

- Long Calendar Spread with Calls - Fidelity.

- Episodes on Calendar Spread.

- PREMIUM SERVICES FOR INVESTORS?

- Using Calendar Trading and Spread Option Strategies?

This would happen if the underlying stock increased or decreased in value by an extreme amount. Under either scenario, the loss would be the premium paid upfront.