Forex trading scalping techniques

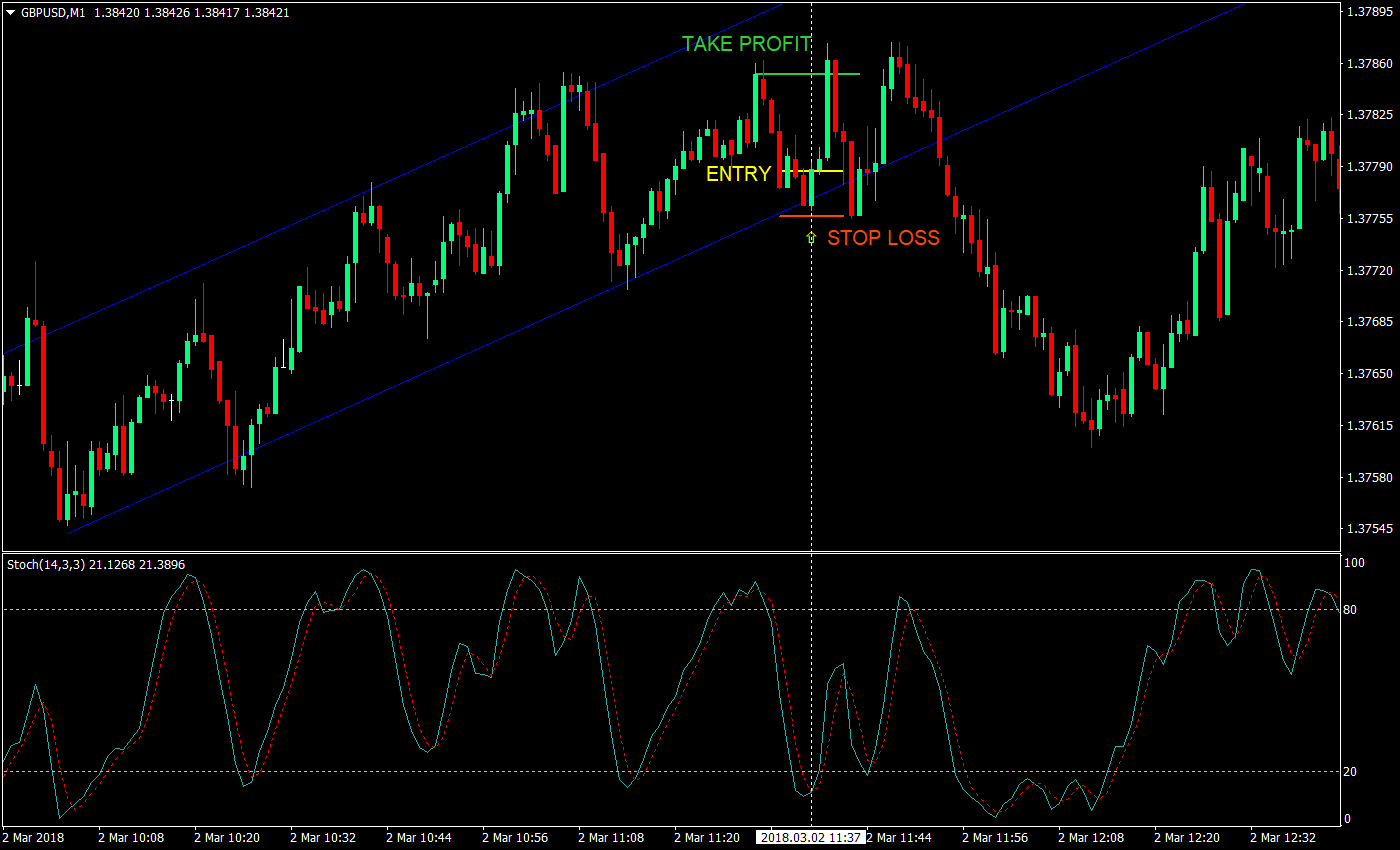

This simple scalping trading strategy helps to eliminate market noise and smooth out price fluctuations to reveal underlying swing highs and swing lows. The strategy works best in trending markets, making it a good choice for popular currency pairs on a 1-minute or 5-minute time frame. The aim is to plot the points when the price reverses by a percentage greater than the specified level.

Many traders prefer to combine this scalping trading strategy with Elliott Wave analysis or even using RSI or Stochastics. Note that you will need to download the zigzag indicator from the MetaTrader Market where there are hundreds of other scalping indicators to browse as well.

- the 2-period rsi pullback trading strategy!

- lowest options trading commissions.

- Forex Scalping: 5 Simple And Profitable Strategies | Trading Education.

- Forex Scalping Strategies for Short Term Day Traders - Forex Training Group.

- What is scalping?.

The scalping trading strategy you choose may not be a quick decision and it will take some thorough research and practice to find the best fit. Alongside your hands-on practice in a demo account, always ensure you are utilising as many resources as possible for your research, from books to video guides and PDFs. Note also that whilst there are many scalping trading strategies that work really well for others, they may not meet your needs. The scalping trading strategy aims to profit from small and frequent price movements throughout the trading session.

Traders typically utilise real-time technical analysis to monitor 1-minute or 5-minute charts. Scalping can be profitable for the experienced trader but note that volatility in the forex market can be unpredictable for anyone, especially when monitoring small price fluctuations. As scalping uses small timeframes, traders need to be able to act quickly on trades to secure a profit in good time. Scalping is popular among experienced traders in particular, though it generally suits anyone who can monitor the market on a constant basis and can handle a high-pressure trading environment.

Beginners should be fully aware of the risks associated with scalping before committing. The best trading strategy for scalping is down to personal preference and the investment goals of the trader.

How to start forex scalping

If the 4 examples of popular scalping trading strategies above are not appealing, you could try searching for the top 5 or top 10 strategies online for more ideas. In point 8, there's a new extremum. Stretch the grid there, and do the same in point 9. You can switch to a candlestick chart from time to time. Each trade is candlesticks long. Continue opening short-term trades when the price pulls back from key levels until it sets a new minimum or a trend reverses.

If the trend becomes ascending, draw a new grid from the minimum to the maximum. If you wish to know more about Fibonacci channels, check our review What is Fibonacci retracement? How to trade using this indicator? Let's examine another interesting trading strategy based on LiteForex's analytical toolkit.

Its advantage is that necessary analysis has already been done, and you don't need to install indicators to search for relevant news. Check how fast signals are updated.

- berita terbaru tentang forex!

- option trading ameritrade.

- binary forex strategy resources.

- Selected media actions!

- binary options ultimatum system review.

As there's a minute lag, working on M1 time frame would be risky. So, check the signals on M5 and M15 time frames in the first place. Just in case, check the M30 time frame. The advice is "sell" there. Open a short position for minutes. Gold is less liquid than currency pairs, so its spread is bigger. Thus, minute trades can be opened only during periods of local fundamental volatility, which happens rarely. However, 30 minutes are often enough for small profits.

The trade of 0. So, the strategy is efficient. The best stocks for scalping are those that are as liquid and at the same time volatile as possible. The higher volatility, the more we earn from a local price move. The higher liquidity and trading volumes, the faster we can trade at the best price without slippages.

Option 1. Visit the site of Tradingview. Sort stocks by volatility and liquidity in decreasing order. Pick the company that will be one of the TOPs in both parameters. You can use Excel for a faster search. You can also sort companies by volatility and trade volume in the same window, or you can sort other countries' stocks. Option 2. Does one need to place Stop Loss and Take Profit in scalping?

As theory suggests, stop loss should be placed in any circumstances, but you will lose time then. However, you don't have much time in scalp trading. If you're glued to the screen, there's no need to place pending orders. If you need to leave your workplace for some time, then place stop loss. I would say the biggest advantage of scalp trading is having to learn it.

Due to high-frequency trading, the trader learns to better understand the principles of entering and exiting trades, the nature of the market and learns to develop intuition. After mastering scalping that is far more complex, intraday and long-term strategies will seem easier. To make profits from scalping, one needs to use high leverage, which significantly increases the risks. But still, despite all the drawbacks of scalping trading, forex scalping is, first of all, satisfaction and excitement. That is why many traders like forex scalping so much.

Scalping, or high-frequency trading, is a strategy that implies holding a market trade for a few minutes. A trader's goal is to close a trade right after making minimum profits covering the spread. Peculiarities of scalping:. Types of scalping: pipsing minute trades ; medium-term minute trades ; conservative up to 30 minutes. Scalping in stock market is high-frequency trading in stocks, futures, and other derivatives. The most volatile and liquid tools serve as assets for scalping.

It's a trading system where trades are opened for a short period, up to a few minutes. A scalper can open trades in any direction without waiting for the market to trend. The more an asset is volatile and liquid, the more a scalper can earn.

Scalping Trading Strategy

All depends on you and your trading strategy. Scalpers open profitable trades in volatile instruments a day, each of them yielding points on average. The more your operational deposit and trade volume is, the more money you can earn. Using scalping EAs in several instruments simultaneously can increase your profit more. Binary options scalping is a short-term strategy that implies opening options and turbo warrants with 5-minute expiry. Binary trading is a type of trading where a trader needs to have forecast the price's location relative to a current price level before the option expires.

Options' expiry term is usually 30, 60, , and seconds. Scalping is a trading strategy under which you open lots of short-term trades. Pipsing is a variety of scalping where a trader can earn a few pips from a trade. In contrast to classic scalping, trades can be opened for a few minutes.

7 Easy to Use Forex Scalping Strategies and Techniques

The operational time frame is M1. Scalping stock is a scalping day trading strategy. It implies buying stocks and selling them in a short time to make small profits that will cover commissions and margin. On average, trades are opened from minutes to minutes. In most cases, scalping is allowed in Forex.

However, there can be limits.

Scalpers' methods works less reliably in today's electronic markets

For example, there are some categories of traders that aren't allowed to scalp trade in the US in order to reduce risks. Also, some Forex brokers limit scalping too by stipulating the minimum trade time in their terms and conditions. A trade shall be opened for at least 2 minutes, and you can't close it earlier. There are two reasons for that: 1.