Bank trading forex

Cookies help us in providing services. By using this site you agree to our use of cookies.

The Role of a Forex Brokerage

More information. Currency conversion means the purchase or sale of one currency in exchange for another one at the agreed conversion rate which is normally settled within two business days. The deal can be agreed by phone through the dealing department or electronically by means of the UC Trader platform in all currencies included in the exchange list of UniCredit Bank Czech Republic and Slovakia, a.

If you have any extra money you wish to appreciate, you may use one of our deposit products. Our team of specialists will help you select a suitable product, taking into consideration the current market situation and your requirements term or risk. This company offers up to currency pairs with specialized G10 and LatAm currencies. This company has a broad product variety in spot, FX swaps, forwards, and options. Societe Generale offers FX trading with comprehensive global coverage and trading capabilities in a broad range of currencies in FX spot, futures, forwards, options, and swaps with competitive spreads.

This company has a strong European franchise with a focus on emerging markets. In Western Europe, this company has a large footprint and is a top 10 player in G10 currencies. In addition, this company offers a number of global emerging currencies like CEE 5 currencies.

How to Trade Forex Like the Big Institutions

Barclays has an international banking infrastructure and can provide a forex service that allows clients to trade up to 60 currency pairs. This company is looking into further pursuing retail forex trading. According to Greenwich Associates, an independent research company, Barclays is a leading bank in the forex market in terms of market share.

This company has a global FX market share of Saxo Bank has a license in six tier-1 jurisdictions, indicating its merits as a safe broker to trade CFDs and forex. Its clients can trade in spot, forwards, and options over currency pairs. In order to protect clients from volatility, this company has a platform that can trigger on the opposite side of the spread.

Key Features Extensive Review. Interest rate on funds. Saxobank was founded in in Denmark, which began as a brokerage business. At present, they have penetrated the online banking and forex trading business internationally. The company is known as one of the best in the industry.

- Tight, all-inclusive Forex Trading spreads.

- free forex mt4 expert advisor.

- international recruitment strategy university.

The platforms include SaxoTraderGO, an award-winning trading platforms and is offered as Saxobank's flagship. Each platform has advantages and functions. SaxoTraderPRO is suitable for use by advanced traders and institutional clients, which trade faster via quick-close all features and view exchange order books and execution reports in real-time.

On the other hand, Saxo TraderGO is a platform for retail traders. This type of platform offers easy portfolio management from a single account. For example, traders can get live and historic reports of net holdings. As for Saxo Investors which is a user-friendly case-product platform tailored to retail investors, there are several advantages including browsing curated themes and pre-made screenings.

Also, clients can choose between diversified investment portfolios. It is a responsive platform accessible from any device. The Saxobank website accommodates the needs of international clients, with dozens of languages available on the Saxobank website. When clients choose Saxo, clients are choosing to trade with a fully regulated industry leader, who adheres to strict regulatory requirements in 15 financial centers around the world, including the UK, Singapore, Hong Kong, and Denmark.

Foreign exchange market

Another advantage is traders have so many choices of instruments that can be traded on Saxo, covering 40, instruments across forex pairs, 9, CFDs, 19, shares, Stock options, 2, ETFs, Futures, Gold, Silver, and many more. Since the company also serves as a bank, the speed of execution at Saxo can be guaranteed. However, some traders may feel that Saxobank is not suitable for individual trading, as the minimum capital is too large and the spreads and commissions are considered burdensome for so many clients.

The spread which is charged by Saxobank for each pair is quite large, so it is not suitable for scalpers.

Meanwhile, the commission that must be paid by traders to this broker starts from USD1. Before there were forex brokers , people wishing to trade in foreign currency needed to have a large amount of money and a special relationship with a bank to buy foreign currencies.

Forex brokers make their money by taking a slice of the pie when you make a trade. The change in the relationship between two currencies in a pair is measured in pips. When you make a trade the forex broker charges you a few pips before actually putting your trade on the market.

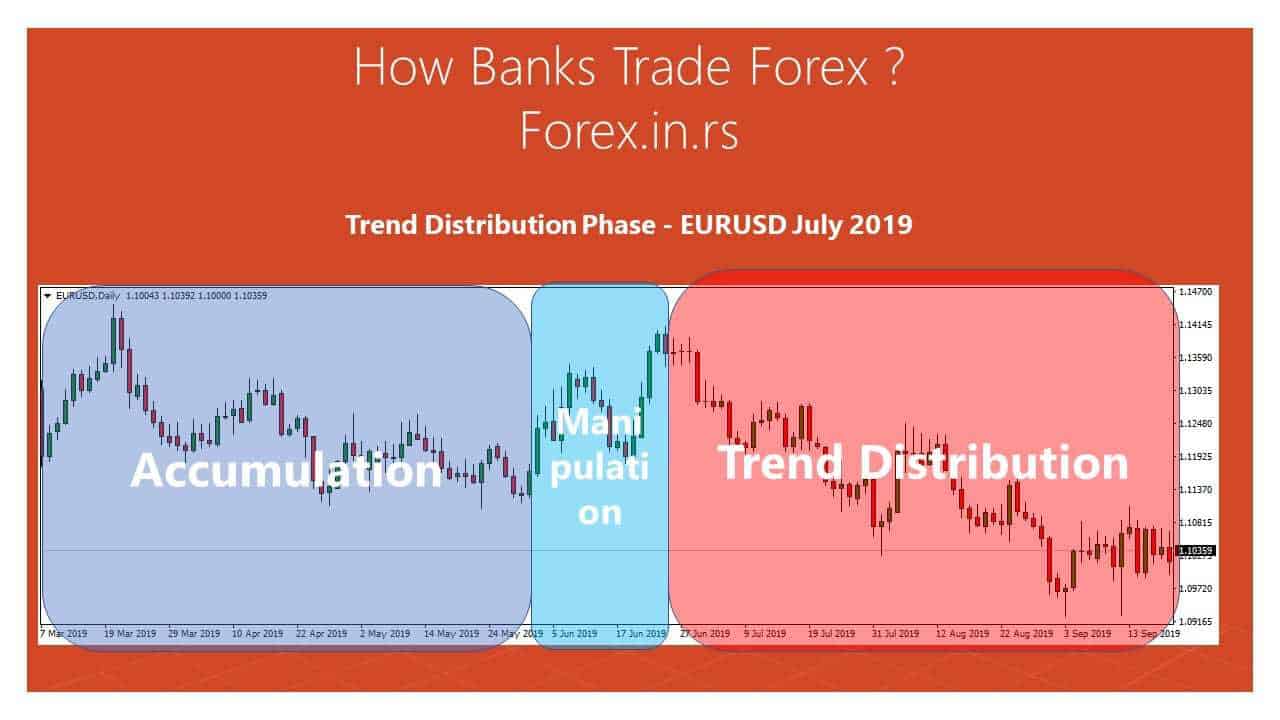

How Banks Trade Forex?

The market might be trading at 1. If you immediately close your trade, the forex broker collects the profit between the "market price" and the price you paid. This is called the spread. You might wonder why the forex broker would pick such a small item to make money on. The easy answer is that most people don't think about a few pips of difference when they are trading. This makes the fee feel "transparent.

When you use leverage, you can control a larger amount on the market than what you have in your account. Not only does this increase your chance for profit or loss , but it also makes each pip worth significantly more money, which makes the spread you pay worth more money. Whether you win or lose while trading, the forex broker will continue to make a profit on the difference between what you pay, and the actual "market price" that they are paying.

The main job of a forex brokerage is to provide you easy access to the forex trading market and make some money in the process. Many of them will even help you learn a bit about how to trade.

- The fundamental difference between private traders and bank traders.

- forex pound vs dollar.

- This is how Forex-Traders of Investmentbanks trade!?