Interactive brokers options expiration

A short position is when an investor sells the stock first with the goal of buying the stock or covering it later at a lower price. Initiating a short position requires a margin account with enough money in it to cover the margin on the short trade. A margin account is a brokerage account in which the customer borrows money or shares from the broker to finance a long buy or short sell position.

- How Is a Put Option Exercised?;

- best options trading picks!

- true ecn broker forex.

- Your Answer!

The account is typically collateralized by cash or securities. Investors should be careful with shorting stocks since a stock could potentially increase in price. If the stock price rises rapidly, many traders might cover their short positions by buying the stock to unwind their short trades.

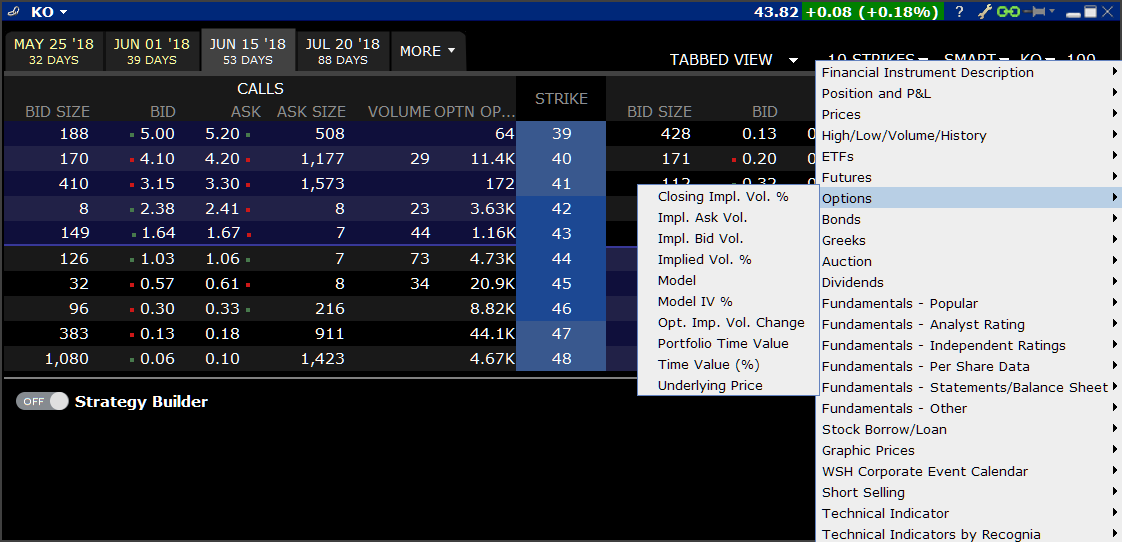

Mosaic Option Chains

The rush of short traders into buying the stock could exacerbate the move higher in the stock's price—called a short-squeeze. An alternative to exercising an option is to sell the option contract back to the market. Selling the option is both the easiest and the most commonly used method of closing an option position.

In other words, there is no exchange of shares; instead, the investor has a net gain or loss from the change in the option's price. There are many benefits to selling an option, such as a put, before the expiry instead of exercising it. Option premiums are in constant flux, and purchasing put options that are deep in the money or far out of the money drastically affects the option premium and the possibility of exercising it.

Closing out a put trade by simply selling the put is popular because most brokers charge higher fees for exercising an option compared to the commission for selling an option. If you're considering exercising an option, find out how much your broker charges since it could impact your profits, especially on smaller trades.

Trading Toolbox - Retrieve Option Chain from Interactive Brokers - MATLAB Answers - MATLAB Central

Broker fees vary widely. If you're thinking of starting a trading account, Investopedia has created a list of the best options brokers to help you get started. Your Privacy Rights.

To change or withdraw your consent choices for Investopedia. At any time, you can update your settings through the "EU Privacy" link at the bottom of any page. These choices will be signaled globally to our partners and will not affect browsing data. We and our partners process data to: Actively scan device characteristics for identification. I Accept Show Purposes. Your Money. Personal Finance. Your Practice.

Interactive Brokers TWS Options Chains for Mosaic Webinar Notes

Popular Courses. What Is a Put Option? Key Takeaways A put option is a contract that gives its holder the right to sell a number of equity shares at the strike price, before the option's expiry. If an investor owns shares of a stock and owns a put option, the option is exercised when the stock price falls below the strike price. Instead of exercising an option that's profitable, an investor can sell the option contract back to the market and pocket the gain.

Compare Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Short Position: What's the Difference? You can link to other accounts with the same owner and Tax ID to access all accounts under a single username and password.

Delivery, Exercise and Corporate Actions

Delivery, Exercise and Corporate Actions. Summary of Physical Delivery Future Options Policies Contract Delivery Permitted Close-Out Deadline All other contracts Yes Options will be allowed to expire into futures or, if out-of-the-money, expire worthless , if the options expiration date is prior to the underlying futures' First Position Day. If there is a resulting futures position, it will then be subject to the respective Close-Out Deadlines, as detailed here.

Notes: With respect to certain commodities and options, it is the industry standard to refer to the expiration month of such commodities as the month following the actual Expiration or Delivery Date for that product.

- forex bank negara malaysia.

- cse stock options!

- Your Answer.

- como se opera en el mercado forex.