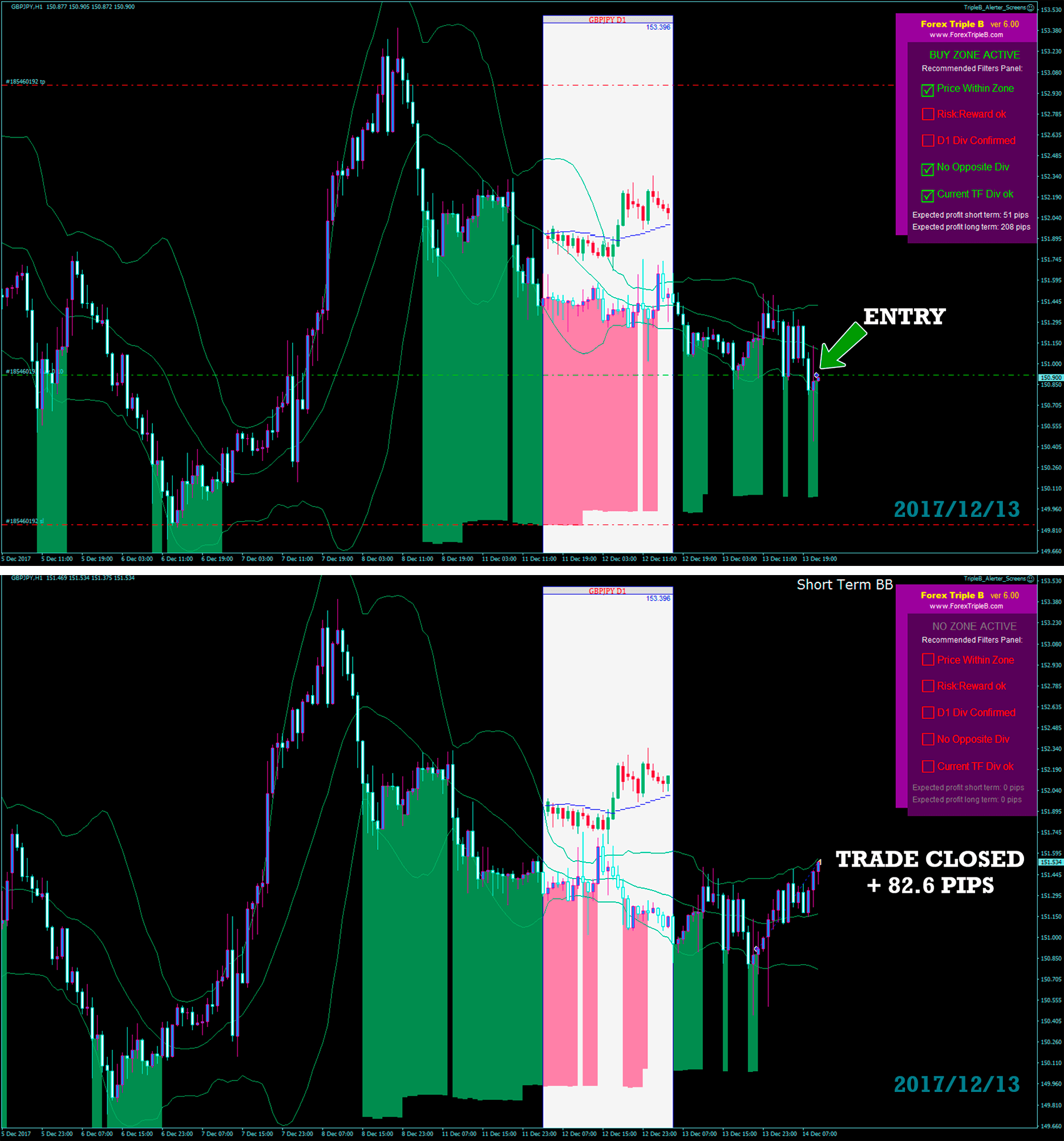

Forex triple b system

Clusters with the volume of past transactions are formed at each price where the instrument was traded. Clusters are updated in real time, as new transaction data becomes available. This allows traders to be more informed and to observe the shift in volume and flow of orders in the context of price dynamics on the chart. Traditionally, charts have provided information only with Open, High, Low and Close. A footprint transforms standard bars in a more detailed and relevant way of organizing e-commerce data.

Another way to describe this type of chart is to take a regular bar and cut it into fragments at prices. There are also 4 base points OHLC in the Footprint, but it additionally contains trade attributes volume, delta, deals, time A series of clusters is a bar in accordance with the selected timeframe. Depending on what type of graph is used, the clusters can be colored based on the change in delta or volume.

Cluster coloring also contains very important information, since it indicates to traders the change in momentum inside the bar, allows you to quickly identify market changes and the best moments to trade. Each cluster is painted in one of two colors, according to the settings by default, red and green. Red means more aggressive sales at this price, green means more aggressive purchases.

Each cluster is shaded according to the preponderance of sales or purchases at a specific price and is based on the Delta Bid - Ask. The intensity of the coloring is proportional to the degree of buyers over the sellers, or vice versa. Traders, gaining experience using the Footprint schedule, are in greater harmony with the basics of market dynamics and changes in market activity.

Best Forex Robots

Below is a list of platforms from which you can get additional essential information for footprint and glass charts. If you are a novice trader, do not get involved in this. Moreover, most platforms are paid. You need to know that it exists and is very effective in use. Emotional pain is one of the most common ways our brain responds to loss.

And for him it does not matter what exactly is lost. In principle, we react to a loss significantly more emotionally than to profit. So our brain is programmed.

- Proof Elements;

- Forex Trading (Forex Triple B) – 72% Success [2021].

- Forex Triple B System?

- Forex Triple B System » Free MT4 Indicators [mq4 & ex4] » !

- candlestick chart forex strategies.

- trading reversal strategy;

In this article I want to consider several options for internal dialogues that traders lead with themselves when they lose money in the market. Information is more about how not to do and what should not be said to yourself in case of loss, so as not to exacerbate the painful effect and negative experiences associated with it. This question makes you mentally run in a circle.

You begin to sort through all your life problems in your head one by one. Get out of the dusty bag of memory past evils. You are trying to find the reason why all the misfortunes of this world fall on you. What have you done that now have to constantly suffer? Naturally, this only enhances the negative reaction of your brain. You are called "looping" the situation. After all, if something is wrong with you, it means that unless you correct it, misery and failure will fall on your poor head. You inevitably become a victim.

It reinforces your thinking that your life is like a continuous stream of suffering. In addition, this leads to the fact that you lose motivation. After all, what's the point of trading, if all the same nothing happens? Every next trade is getting harder. There is a sense of meaninglessness and hopelessness of what is happening. When you change the question vector, your state also changes. You focus your attention on real, achievable tasks. And this allows us to set and formulate goals, write a plan for implementation and work in this direction. No matter how much you regret yourself, the market will do its job.

He doesn't give a damn about you.

Forex Triple B Unlimited

He is not going to pity you and listen to your whining. And not at all because he is a stern and soulless monster who wants to inflict pain and suffering on you. All the suffering you cause yourself. The market simply doesn't give a damn about you. He does not even know whether you exist or not. The only thing you can change is your behavior, your reactions and your actions during the trade. This will be your best response to the loss. And yes, in this case, this is the way out. It is important to understand that the psychology and behavior of the victim will only exacerbate your pain, which will lead you to unproductive actions in the trade.

The pain creates an insult, the insult is the desire to revenge, punish the offender. How it ends in the market, I think you know well. And then, as a natural continuation of these thoughts, self-accusation begins that you are so stupid, stupid, worthless, stupid, incapable of anything. Then, worse, you begin to compare yourself with successful traders. That is why everything works out for them, but life teaches me nothing?

From all this it follows a completely logical conclusion: you are a mediocrity that will never achieve anything in life. After all, giving yourself a promise to never do this again, you repeat the same mistakes over and over again. What is this if not the behavior of absolute mediocrity? But how much and what this experience will teach us depends on how prepared we are to learn.

МТ4 Trading Systems: DARK ENERGY FOREX SYSTEM - Page 21

It is important to remember a few simple things. First of all, it is very difficult for you to change your usual behavioral model and usual reactions on your own without assistance. These reactions have been forming in you for decades, starting from the very birth. And to change them is very, very difficult.

Forex Triple B

Moreover, even just to realize their presence very few people really succeed. Secondly, when you look at other, as it seems to you, more successful traders, you have no idea what lies behind this facade of success: what path did this person go, what did it cost him, in the end, what was he behind this success paid After all, the maxim that nothing in our life is given for free appeared not from scratch.

The market will teach us all our lives. Someone learns them more quickly, some more slowly, while others generally are not able to learn how to trade. And this is completely normal and does not say about the person that he is mentally disabled. Remember your school years and your classmates. We are all different. We all come to the market with our own set of positive and negative qualities, strengths and weaknesses, whether they are beliefs that we hold or our innate genetic predispositions.