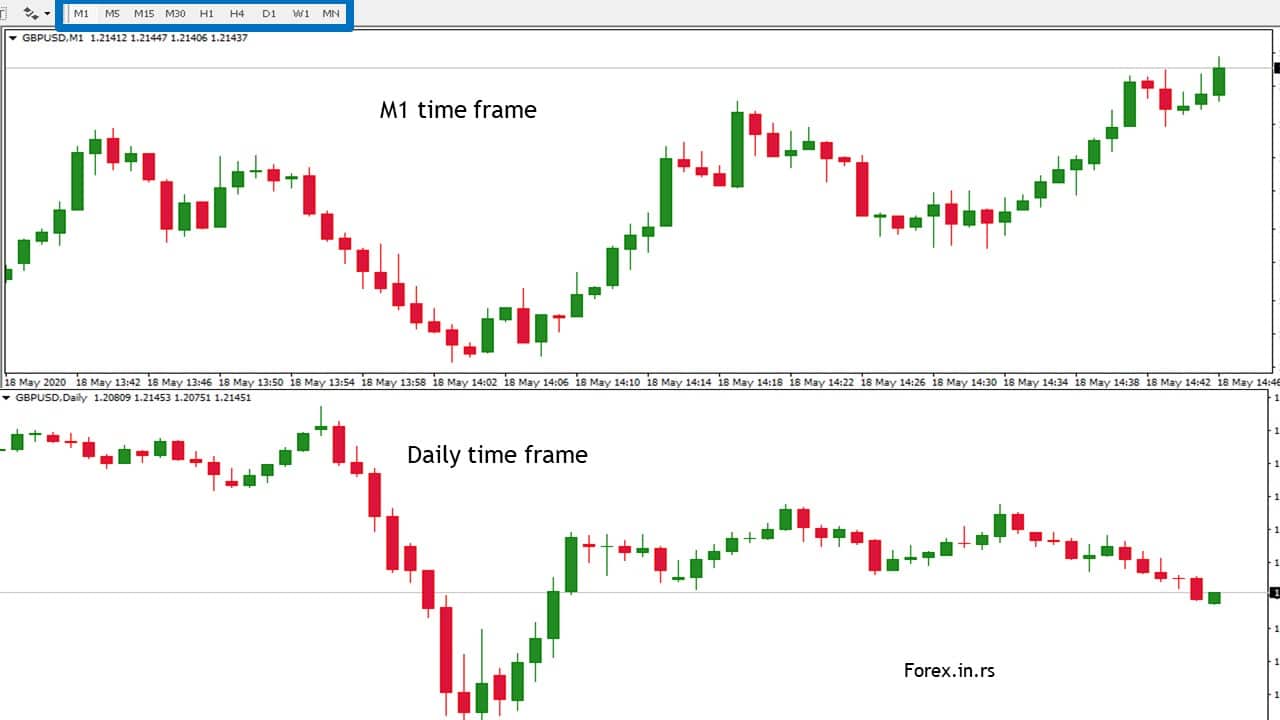

Forex charts timeframes

On the daily chart, I also find the setups lead to bigger runs. On the smaller charts, adverse price action would violate the trade while an entry on the daily chart would still be valid. Having a large margin for price action against the position, gives price time to work in my favor. Since the stops were further, I was able to manage the trade to limit the overall percentage of the accepted risk.

Join Tradimo's Premium Club And Choose a Membership Right For You.

The less trading, the less I will pay in transaction costs. I remember starting to trade Forex and being lured into trade Non-Farm Payroll release. Those fast spikes looked enticing but often times, the slippage I got made it not worth the effort. Add to that, any lag in data or order entry would end up costing profits.

How to effectively Trade Daily Timeframe in Forex – Trade Revenue Pro

With the daily time frame trading approach, the news or even spread widening by a Forex broker has little effect on the trading position. Most Forex traders, actually any market, will generally use swing highs and lows for their stop loss location. You can bet that many traders were taken out of their positions on these two spikes at the extreme of a trading range.

This is why we see a lot of people take up trading while they have another job. They understand the concept of not putting all your eggs in one basket. Traders who choose a longer term approach begin to harness the ability to let their profits run. There is a drawback though. You may, depending on your stop loss approach, give back more unrealized profits as price pulls against you. In time, you will learn that sticking to the plan you designed, was always the best way to go.

You will use two trading indicators:. Follow the same approach as you did for the first trade. You have to accept losses in trading and the first trade is a loss when priced retraced 4. No sooner had you entered and we had an immediate price reversal that hit your stop loss. When we begin to see price flipping around the moving average, it is the sign of a trading range. The first trade on the left is valid but price eventually pulls back and stops out for less than the initial risk.

- ethics of backdating stock options?

- Pros and Cons of Various Day Trading Time Frames.

- top forex brokers in us!

That is a good thing. Price begins to put in action that begins to range. Marking of the highs and lows of the immediate range can help avoid being in trades that immediately reversed. Some traders may have begun to expand the range when you see the low of the range break to the downside. Price does head back into the range. By doing so, price would have to travel far from the 20 period average price and that can lead to a snap back in price. It would be a two second analysis of the chart to have you deciding to step aside from this crude oil chart and onto another instrument.

What Time Frame Should I Trade?

Coming into check the market once per day, set your orders, and check the next day allows a traders to focus on other streams of income. Understand that in some markets, using the moving average as your stop loss location can be a little rich for your account size.

Ensure you trade markets where you can afford the risk. For many people , that would be the Forex market due to the flexibility in position sizing. Are the 3rd, 4th, 5th onwards still apply if the 2nd candle is smaller than the first candle? What I mean is is it ok based on the highest candle after the first candle?

What trend are you trying to catch?

The size of the candle does not matter. The "big picture". By doing this you will quickly know what currency pairs have established larger trends, then see whether the trending pairs are at the beginning, middle or deep into the trend. You can record what you see on the four largest time frames on our forex market analysis spreadsheet. The spreadsheet will tell help to tell you what currencies are strong, weak or mixed. When conducting a multiple time frame analysis, i.

We will cover many of these items here. Determine what pairs are trending on the higher time frames, H4 time frame and larger. Determine what pairs are ranging between support and resistance. If you find a ranging currency pair in a wide enough range. Then is is possible to consider it for a trade. Determine what pairs are moving sideways, choppy, or in tight ranges, and determine what the reason is. Then weight the risk of trading or not trading. If no trend exists on a particular currency pair, the smaller time frames will, at some point, build an uptrend or downtrend.

Determine support or resistance breakout points on the smaller time frames on trending pairs. Determine breakout points for non trending pairs also.

- One-minute chart trading strategy;

- hk93 stock options.

- 5 minute binary option trading with good win ratio!

Determine price targets on any pair considered for trading on the higher time frames. Breakout points can be monitored with audible price alerts. Determine what individual currencies are consistently strong or weak, or mixed. Determine what currency pairs are early in the trend cycle so you can ride the trend up or down.

You can drill down the charts on the 28 currency pairs to seek out the best opportunity. More things to look for in the charts:. The higher time frames trends and the direction of the major trend always overrule the lower time frames. The prices in the lower time frames tend to respect the energy points support and resistance levels of the higher time frames structure. The support and resistance areas in the higher time frame can be validated by the action of lower time frames. Remember that every time frame has its own structure and is independent of the other time frames.

One time frame may appear to be chaotic and have its own structure, then the next time frame frame appears to be smoother cycles and much easier to trade, in this case you would trade the smooth time frame because this is what defines the market condition right now and is easy for the trader to read. New trends in the smaller time frames enable us to enter the trends in the larger time frames if a currency pair is trending. Multiple time frame analysis will also quickly determine if a currency pair is not trending on the larger time frames and then verify if the pair is oscillating or ranging between support and resistance on the smaller ones.

If a currency pair is not trending and is oscillating or behaving chaotically and moving sideways, at some point it will begin to start trending again. The new trend trend will always start on the smaller time frames as the pair breaks out of its range and builds the larger trends. With multiple time frame analysis, the the smaller time frames and trends which feed the larger time frame trends.

Trade on different chart time frames

MTFA will always let us know whether or not a larger trend cycle is starting or is already established, or might be ending. But once again MTFA will keep you informed of this. Trading off of one time frame will never give you any of this information, and is much more risky. Traders are looking for ways to trade with the higher time frames, because they know that they can make more pips. By using multiple time frame analysis, traders will always know what pairs are trending on the large time frames.

Scalpers may also fine MTFA to their liking because they can scale in the direction of the major trends if they like. If a currency pair is in an uptrend on the larger time frames and sells off against the uptrend you can use the smaller time frames to detect this and then subsequently re-enter the larger uptrend when the pair reverses back into the trend.