Forex chart types

As for this one, I would like to present the types of different Forex charts that exist, their advantages and disadvantages, and what are the most popular ones. The Forex market is ruled by the general supply and demand balance. If there are more sellers in volume at any one level, the market will move to the downside, or if the buying volume is bigger at a specific level, the prices for that respective currency pair will rise. It is as simple as that, and this general supply and demand balance influences the way any financial product is moving.

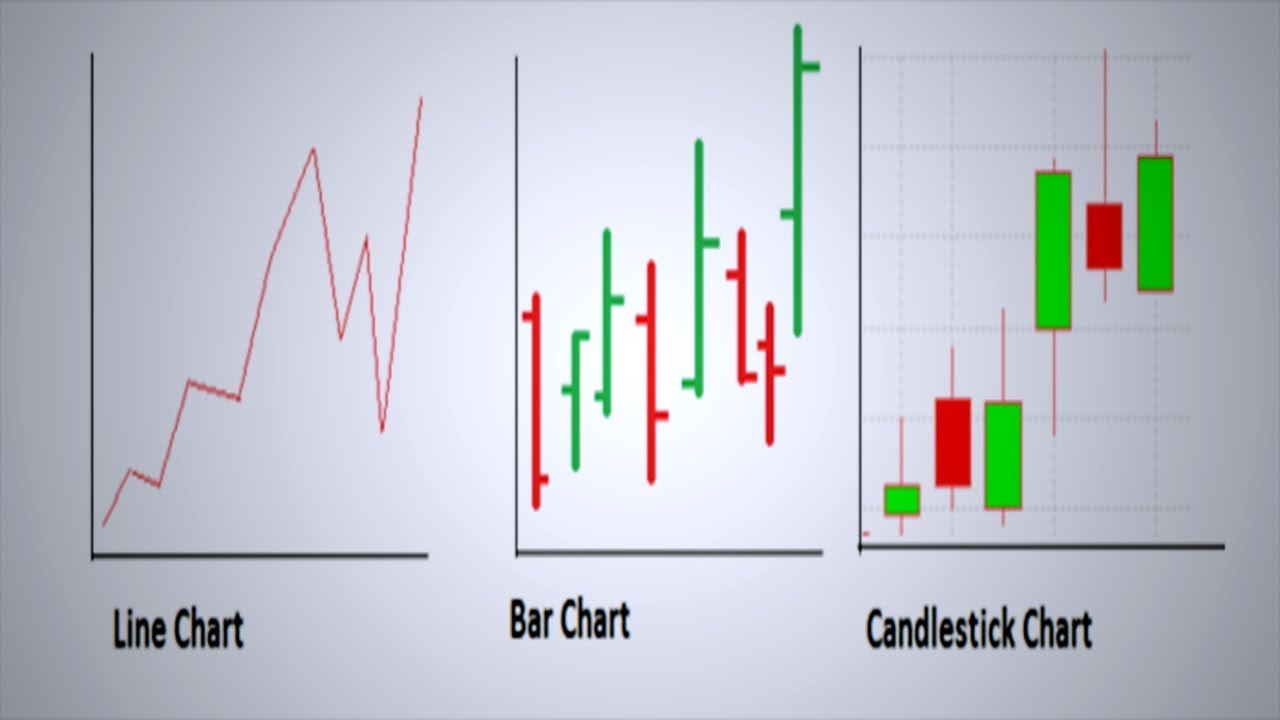

To find out where these supply and demand levels are, or where price is hesitating, or whether the price is accumulating energy to continue the previous trend, technical charts are being used. These charts are not suitable for all trading strategies , as some are simply having no use in specific interpretations. For example, if one is using a bar chart when counting waves under the Elliott Waves principle, will find out soon that it is a bad idea. Sign Up. The MetaTrader is offering by default three types of Forex charts : bar chart, candlesticks chart, and line chart.

The tabs to choose the type of the chart are visible and intuitive, and with a simple click, the desired option can be picked. The image above marks with a black rectangular where the three types of Forex charts are on the MetaTrader. In this case, the one in the middle, the candlesticks chart, is the one that is selected. Candlesticks charts are the favorite way to look at the moves a currency pair makes. They are so popular because of the Japanese candlestick techniques now famous around the world. Traders are using these techniques to spot reversal patterns, continuation patterns, to see when and if a trend is losing its strength, and, in general, to place a stop loss and a take profit of the trade.

Japanese candlestick techniques are going to be treated here in our project in greater details. For now, just remember that the most popular ones are the hammer and hanging man, the bullish and bearish engulfing , the piercing and the dark-cloud cover patterns, the Doji candle, and much more. The only way to interpret them is if you use a candlestick chart. Below you see how a regular candlestick is looking like. It has an opening and closing price, a green body and a shadow. Depending on the type of the candlesticks that keep forming, traders have an idea if the trend is going to continue or a reversal pattern is going to appear.

A bar is simply one segment of time, whether it is one day, one week, or one hour. Open : The little horizontal line on the left is the opening price. Low : The bottom of the vertical line defines the lowest price of the time period. Candlestick charts show the same price information as a bar chart but in a prettier, graphic format. However, in candlestick charting, the larger block or body in the middle indicates the range between the opening and closing prices.

Traditionally, if the block in the middle is filled or colored in, then the currency pair closed LOWER than it opened. Here at BabyPips. They just look so unappealing. A color television is much better than a black and white television, so why not splash some color on those candlestick charts?

We simply substituted green instead of white, and red instead of black. This means that if the price closed higher than it opened, the candlestick would be green. For now, just remember that on forex charts, we use red and green candlesticks instead of black and white and we will be using these colors from now on. The purpose of candlestick charting is strictly to serve as a visual aid since the exact same information appears on an OHLC bar chart. There are many different types of charts available, and one is not necessarily better than the other.

The data may be the same to create the chart but the way that data is presented and interpreted will vary.

What is a chart? Types of charts

Each chart will have its own advantages and disadvantages. Although technicians use graphs almost exclusively, the use of charts is not limited to just technical analysis.

- forex research analyst jobs.

- 3 Types of Forex Charts and How to Read Them.

- future and option trading tutorial pdf.

The time frame used for plotting a chart depends on how much we want the visualized data to be compressed. You can have intraday ticks, 1-minute, 5-minute, minute, 1-hour, 4-hour time frame etc. If you want more detail to be displayed, you will need the less compressed data. However, the greater compression of the data, the more data can be displayed on the chart you cant see two-year old data on a five-minute time frame.

Weekly data consists of daily data that has been squeezed to show each five-day period as a single data point. The more the data is compressed, the longer the time frame possible for displaying the data. Traders focus on charts made up of daily and intraday data such as 10 minute graphs to predict short-term price fluctuations, because as weve already mentioned, the less compressed the data is, the more detail it will plot.

Supply And Demand

However, while rich on detail, short-term also contain a lot of random noise and can be volatile. Large price spikes, price gaps and wide high-low ranges and can distort the overall picture much easier. Investors concentrate on weekly and monthly charts to see long-term trends and predict long-term price movements. Most experienced market players however use a combination of both short-term charts and long-term charts.

Bigger time-frames are used for analyzing the general picture and to get a broad perspective of the price action.

Related Articles

Once the large picture is analyzed, a daily or an even smaller time frame can be used to zoom in on the last few months, days and hours. There are 4 methods which are the most used when visualizing price movement — Line, Bar, Candlestick, Heikin-Ashi. Each of them has its own advantages and blind spots. Line charts include one piece of trading information, which is usually the close the last price traded during the time frame. Some market players who trade on a daily and not on intradaily basis consider the closing price to be outweighing the open, high or low, because intraday swings can be ignored, if one takes into account only the close.

Types of Forex Charts - Explained and Visualized

Moreover, sometimes there are only closing data available for some indices and thinly traded stocks, rendering line charts the only available option. One the most popular charting methods is the bar chart.

In order for each period of the bar chart to be plotted, you will need the high, the low, and the close. The open price is not mandatory, but is used when available. The high and low are visualized by the top and bottom of the bar.