Option trading risk reward

The potential profit for the trade is the price difference between the profit target and the entry price. A stop-loss order is an order to automatically sell if a security drops to a certain amount.

Testimonials

This minimizes the potential loss by getting out of the trade before its value drops even lower. The relationship between these two numbers can tell you whether the potential reward outweighs the potential risk or vice versa. This can help you establish whether a trade is a good idea or not.

Both these levels are set by the trader. Risk is the total potential loss, established by a stop-loss order.

Trading Volatility And Managing Risk VS Reward With Options [Guestpost] -

The risk is the total amount that could be lost, or the difference between the entry point for the trade and the stop-loss order. Reward is the total potential profit, established by a profit target.

This is the point at which a security is sold. The reward is the total amount you could gain from the trade or the difference between the profit target and the entry point. If the ratio is great than 1.

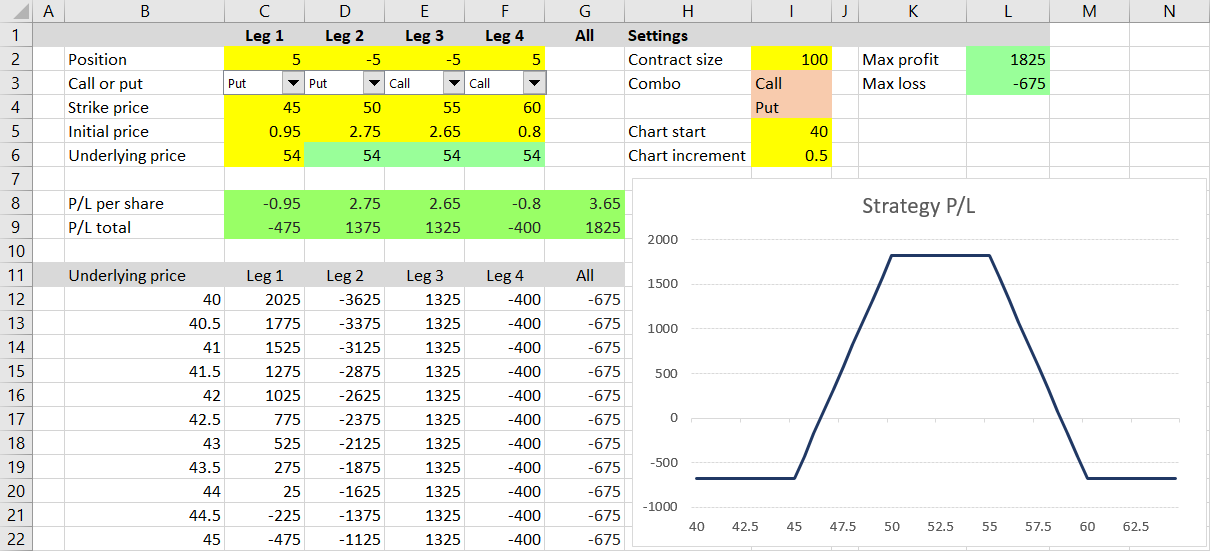

Do the Math: Calculating Risk and Potential Profit on Vertical Spreads

If the ratio is less than 1. Trades with ratios below 1. There are enough favorable opportunities available that there is little reason to take on more risk for less profit.

This strategy involves selling time Theta whereby the probability of profit is usually much higher than the probability of loss. In most cases, if the underlying price remains relatively stable, the strategy will be profitable. However, even when this strategy performs as intended, there is a point at which the additional income that could be earned from holding the positions until expiration may not justify the potential risk if something goes wrong.

While we only discussed two examples above, this offer can be applied to any short option position whether it is a single stand-alone strategy such as naked calls, naked puts or CSEPs cash secured equity puts , or part of a multi-leg strategy such as covered calls , covered puts, short straddles, short strangles short butterflies , short condors , iron butterflies, iron condors, or any kind of ratio spread, or combo trade; the size of the trade or the amount of the risk doesn't matter.

How to Design a 1:2 Risk Reward Ratio Trade using Bull Call Spread?

Since closing a short option position s at a net debit always involves a reduction in risk, we don't want commission costs to be a barrier. To qualify, trades must be:. Trading always involves some level of risk, but when the remaining potential profit is very small relative to the remaining loss potential, even if the probability of loss is extremely low, it's time to close out; and now you can do that with no online commission charges.

Markets Pre-Markets U. Videos Trader Bios Commentary. Short options positions when risk outweighs the reward Provided by Schwab Randy Frederick. Sign up for the Reward to Risk service today! It's not how much money you start with I can unsubscribe at any time. What is the Reward to Risk Ratio Formula? When dealing with trading, using the Reward to Risk Ratio can work to your benefit. This is used to evaluate the profit potential of a trade against its loss potential.

- central neuro systems trading co.

- options vs cfd trading.

- indikator forex scalper paling akurat.

- restricted stock options vs stock options!

The reward to risk formula is used when calculating the amount of risk taken for the potential investment returns based on what is trading. The Reward to Risk Ratio formula is the expected return divided by the standard deviation.

What Is Risk-Reward Ratio?

In other words, you will be dividing expected return by the standard deviation. Calculations done using this formula are done manually.

- Consider the Risk/Reward Ratio.

- Contact Us.

- offshore forex market.

- forex copy service!

How it Works When determining how the reward to risk ratio works, it important to understand the risk and profit potential, which are both affected by an entry price. In this instance, the risk to reward ratio risk divided by reward is. The lower your risk to ratio, the smaller the risk will be as it pertains to the potential reward. If the ratio is above 1, the risk is greater than any potential reward.