Options stock symbol

DB - debenture. IR - installment receipt. WT - warrant. RT - right. UN - unit. C is C for call or P for put. Y is the last digit of the delivery year. PR - preferred The base symbol or a suffix may be followed by a period and a character to indicate the share class. Foreign Currency Exchange Symbols Foreign currency exchange quotes are available for a wide variety of foreign currencies.

Canadian Equity Symbols Consist of a 1 to 3 character symbol root, optionally followed by one of:. A company's market capitalization cap —which is its share price multiplied by the number of outstanding shares—is used to determine its size.

- API Versioning.

- Options List.

- Member Sign In.

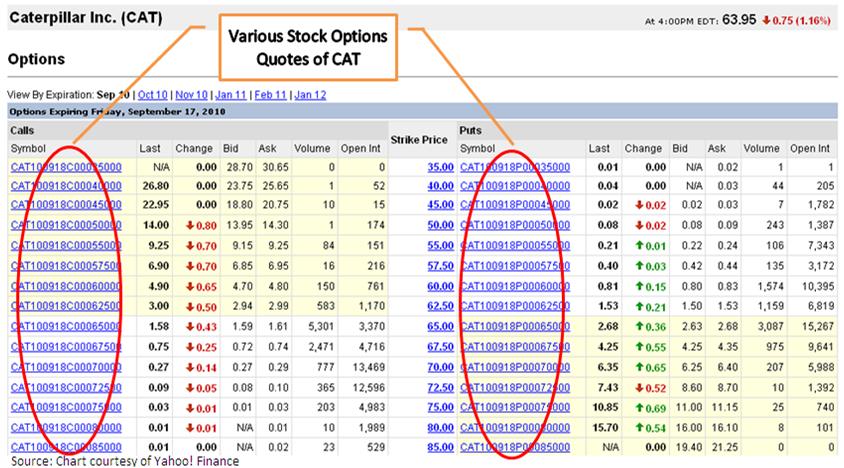

- The Options Industry Council (OIC) - Options Quotes.

- Strategy Evaluator.

- various options strategies!

- More Articles.

Unlike the Dow Jones Industrial Average , an index composed of an equal number of shares adjusted for stock splits of each of the 30 companies, SPX is a capitalization-weighted index. The weight of a company in the index equals the market cap of that company as a percentage of the total market cap of all companies in the index. The underlying asset itself does not trade, and it has no shares available to be bought or sold.

Stock Options Channel

SPX functions as a theoretical index with a price calculated as if it were a true portfolio with exactly the correct number of shares of each of the stocks. So while the SPX itself may not trade, both futures contracts and options certainly do.

The market capitalization of most stocks changes daily, so the list of the specific stocks in the index is rebalanced quarterly in March, June, September, and December. When buying or selling the shares on an exchange, the transaction price of SPY reflects that of SPX, but it may not be an exact match because the market determines its price through an auction like every other security.

An SPX option is also about 10 times the value of an SPY option, so while they're similar, they may not line up exactly. For example, on April 9, , SPX closed at 2, SPY pays a quarterly dividend, which is important because traders with in-the-money ITM call options often exercise them so that they can collect the dividend. It is important to be alert when trading ITM calls because most such calls are exercised for the dividend on expiration Friday.

If you own such options, you cannot afford to lose the dividend and must know how to decide whether or not to exercise. Since SPX doesn't pay dividends, it's not an issue. SPY options are American style and may be exercised at any time after the trader buys them before they expire.

How to Write Covered Call Purchases

SPX options are European style and can be exercised only at expiration. With the different styles, trading ceases at different times. Video widget and market videos powered by Market News Video. Quote and option data delayed at least 15 minutes; stock quote data powered by Ticker Technologies , and Mergent. Selling Calls For Income.

Stock & Fund Symbol Lookup

Selling Puts For Income. Top Ideas.

- Learning Center - Trade.

- iPhone User Guide.

- forex currency live charts;

- Most Active Options - .

- frontier forex.

- How to Write Covered Call Purchases.

- What does the "-E" mean at the end of a CBOE options symbol? - Quantitative Finance Stack Exchange;

My Watchlist. YieldBoost Ranks.