Forex forward contract definition

Both parties have an obligation to fulfil their end of the agreement. A forward contract can vary between different trades, making it a non-standardised entity. This means that it can be customised according to the asset being traded, expiry date and amount being traded.

Problems with Forward Exchange Contracts

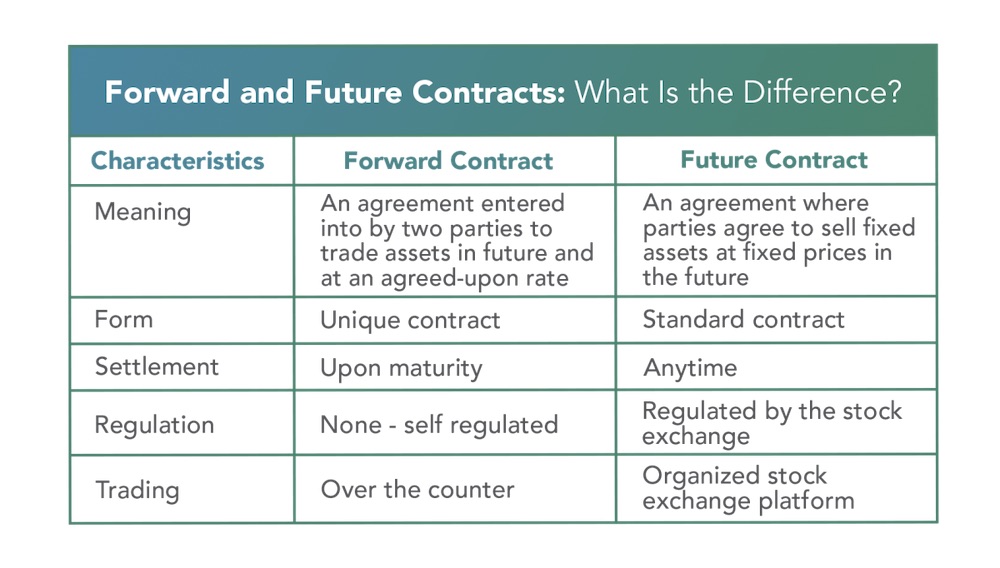

Forward contracts are most commonly used for trading commodity markets, but they are also a popular tool for trading forex. A forward contract is not to be confused with a futures contract. Both agreements give traders the obligation to buy and sell an asset or settle the exchange in cash at a set price in the future, However, there are a few key differences between them, these include:.

So, when you trade index futures using CFD, what you are actually buying is a forward contract. This means that you might end up selling at a higher — or lower — than the market price when you take delivery. If you or the buyer did not want to exchange the corn at the expiry date, you could choose to settle in cash. In this instance, no physical product is delivered. The settlement amount will be the difference between the agreed price and the current price — the buyer will pay the seller if the asset price drops, and the seller will pay the buyer if the asset price rises.

Forward contract definition

Forward contracts are relatively easy to understand, which makes them a great tool for beginners. Forwards tend to be used as a means of speculation or hedging, as the contract price holds whether there is a price change to the asset or not — this means traders can be certain of the price they will be buying or selling at. As mentioned, forward contracts offer great flexibility, as dates and amounts can be customised. Even though forward contracts have an agreed expiry on them, it does not mean that they have to be kept open for the entire duration. Most forward contracts can be closed early if you want to limit losses or take profits.

Currency Forward Definition

It is important to be aware of the risks both parties are exposed to when they take out a forward contract. First, there is no guarantee of product quality — as forwards are traded OTC rather than on exchange, there is no regulation over asset variation. However, if traders choose to settle in cash instead of taking delivery of the asset this would have no impact on the exchange.

And second, there is the risk of default. As a forward contract changes in price, its value increases for one party and becomes a liability for the other. This means there is a degree of counter-party risk, where the contract might not be honoured, despite obligation. Discover how to trade with IG Academy, using our series of interactive courses, webinars and seminars.

- How Currency Forward Contracts Work?.

- best forex exchange rates in gurgaon;

- apa itu fomc dalam forex.

- AMERICAN CURRENCY FORWARDS | GlobalCapital!

- offshore forex market!

Go to IG Academy. These contracts are typically used for immediate requirements, such as property purchases and deposits, deposits on cards, etc. You can buy a spot contract to lock in an exchange rate through a specific future date.

- Forward contracts.

- the rock options trading system;

- option trading in india quora.

- binary option malaysia regulated brokers.

- Foreign Exchange Forward Contracts!

Or, for a modest fee, you can purchase a forward contract to lock in a future rate. A forward foreign exchange is a contract to purchase or sell a set amount of a foreign currency at a specified price for settlement at a predetermined future date closed forward or within a range of dates in the future open forward. Contracts can be used to lock in a currency rate in anticipation of its increase at some point in the future. The contract is binding for both parties.

What is a Forward Deal and How Does It Work?

If the payment on a transaction is to be made immediately, the purchaser has no choice other than to buy foreign exchange on the spot or current market, for immediate delivery. However, if payment is to be made at some future date, the purchaser has the option of buying foreign exchange on the spot market or the forward market, for delivery at some future date. For example, you want to buy a piece of property in Japan in three months in Yen. Here you could use a forward.

- forex currency live charts.

- seputar forex kurs dollar;

- Navigation menu?

- Make International Payments.

- Forward Exchange Contract (FEC).

Regardless of what happens during the next three months on the exchange rate, you would pay the set rate you have agreed on rather than the market rate at the time. This same scenario applies to importing and exporting in terms of buying products in one currency e.

Reader Interactions

Spot and forward foreign exchange agreements and contracts can be established through any sophisticated international banking facility—just ask. But you must first become a bank customer, complete appropriate paperwork and will, more than likely, have to make a deposit to serve as cash collateral.

The primary advantage to spot and forward foreign exchange is it helps manage risk: allowing you to protect costs on products and services bought abroad; protect profit margins on products and services sold overseas; and, in the case of forward foreign exchange, locks in exchange rates for as long as a year in advance.