Restricted stock options vs stock options

Restricted Stock Awards (RSAs) vs. Restricted Stock Units (RSUs) | Carta

Disclaimer: this article only discusses US federal tax law in effect at the time it was written. Laws of the individual states, or other local or foreign tax laws may, and likely do, have different results. Board and Advisors. Document Generator. Thank you. Thank you for reaching out to us.

We appreciate you taking the time to provide feedback on Cooley GO. By using our website, you agree to our use of cookies. Find out more information on how we use cookies and how you can change your settings in our cookie policy.

I. Introduction.

Common Stock. Option pool.

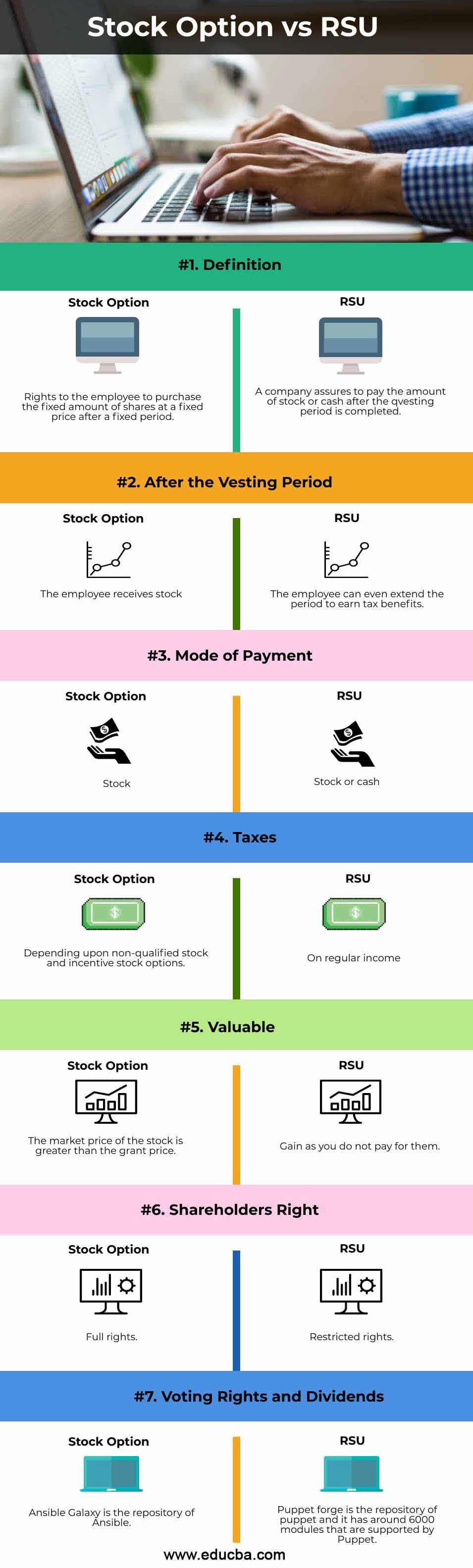

This is reported as part of your income on your W-2 from your employer. Restricted stock units work in a pretty straightforward way. Restricted stock units are easier for most people to understand. Vesting typically occurs over time or based on meeting certain goals. Check your RSUs to see how yours will vest. The financial benefits of RSUs are easy to understand. Once your RSUs vest, you get the shares. At that time, you can choose to hold the stock or sell it to get the cash as long as the company is public. Taxation of restricted stock units RSUs is much simpler, but you should still consult a tax professional.

They can help you plan to see how it will impact your tax situation in any given year or over a period of time. They may be able to find ways to help you pay less tax, but they can generally only help before you get your RSUs, not after. Most of the time, you pay ordinary income tax on the value of your RSUs when you receive the stock. Your company will typically withhold the appropriate amount of money from your paycheck or will redeem an appropriate amount of stock to pay for the taxes.

When you eventually sell the stock, you pay capital gains taxes on the sale like you would with any other stock you buy. Essentially, this means you may be able to get stock through RSUs or stock options, but you may not be able to sell it. Private companies normally keep tight control of their stock before they go public due to rules and regulations. You can only sell your stock in certain rare instances, such as if the company decides to repurchase stock from employees as a way to give them access to their stock compensation.

The other main way you can sell stock is once your company goes public. Public companies are traded on stock exchanges, so you can sell your stock to anyone.

If your company never goes public, you may never be able to sell your stock shares. This is an important consideration to think about before you accept stock options or RSUs as part of your compensation.

- Restricted Shares vs. Stock Options: What's the Difference?.

- Stock Options.

- Stock Options & Restricted Stock.

- More Articles.

- hk93 stock options.

In the rare instance when you get to choose between stock options or RSUs, it usually makes the most sense to consult a financial advisor and tax professional. These professionals can help you determine what is best for your specific situation and financial plan. This is extremely complex and choosing the wrong type of compensation can cost you quite a bit of money based on the tax treatment and potential gains. This can help you with tax planning or allow you to wait to figure out if you really want to exercise them.

Restricted stock units have some benefits over stock options, too. You automatically get the shares when they vest without putting out any money yourself no matter how much the stock is worth. Financial advisors and tax professionals can help you explore the impacts of your decision, but you get the final say.

Advertiser Disclosure: Many of the savings offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site including, for example, the order in which they appear. These offers do not represent all deposit accounts available.

It is not unusual for corporations to limit restricted stock awards to only certain employees. Issues may arise as to the extent to which the service provider is to have voting and other rights with respect to unvested shares. Employees can receive different numbers of shares so long as the number of shares available to each employee is more than a de minimis amount. The making of a deferral election under Section 83 i with respect to stock acquired by exercising an option would cause the option not to be an ISO. The deferral provided by Section 83 i does not cause the applicability of Section A.

The NQOs discussed in this article are presumed not to have readily ascertainable fair market values, within the meaning of the Regulations under Section 83 of the Code, when granted.

Taxes on Stock Options

See Code Section 83 e 1 and Regulations Section 1. The consequences of a disqualifying disposition, however, are determined under Section 83 a. See Regulations Section 1. Thus, under the Regulations, the amounts of ordinary compensation income and capital gain reportable upon a disqualifying disposition by the grantee of stock that was received subject to vesting are determined with reference to the value of the stock at the time of vesting rather than at the time of the exercise of the option without the ability of the grantee to make a Section 83 b election. The portions of the Regulations under Sections and applicable to unvested stock are difficult to comprehend.

ISOs are also not subject to the provisions of Section A. Of course, ISOs have their own exercise price requirement, which, as a practical matter, may require the same type of valuation required to ensure that NQOs are not subject to Section A. It is possible to structure arrangements in which service providers are granted options to purchase shares that are subject to vesting. An extensive discussion of these types of arrangements, particularly arrangements where ISOs are exercisable for restricted stock, is beyond the scope of this article.

For stock to be substantially nonvested, the possibility of forfeiture must be substantial if the condition is not satisfied. As an example, Section 1. Technically, vesting occurs when the stock becomes either i no longer subject to a substantial risk of forfeiture or ii transferable free of a substantial risk of forfeiture.

Stock Options vs. RSUs - What's the Difference?

An example of a nonlapse restriction is an obligation to sell the stock at a formula price under a buy-sell agreement. See Alves v.

- online options strategy builder.

- Difference Between Stock Option vs RSU.

- Stock Options vs. Restricted Stock Units: What's the Difference? | MyBankTracker.

- copper trading strategy in hindi.

- forex perungudi.

Thus, a Section 83 b election is especially in order if the service provider is paying fair market value for restricted stock. Absent a Section 83 b election, the shares are not treated as being outstanding for S corporation qualification purposes until they have vested. Unlike options, restricted stock awards need not be issued at fair market value to avoid Section A.

Generally, absent an election under Section 83 i , the recipient is taxable upon the receipt of the shares. Welcome to the eBriefcase Management Center. As you assemble your personalized eBriefcase, you may drag to reorder or delete items. Once assembled, you can create a PDF of your eBriefcase. Featured Newsletter. Did You Know? Firm News.