Calculate margin forex formula

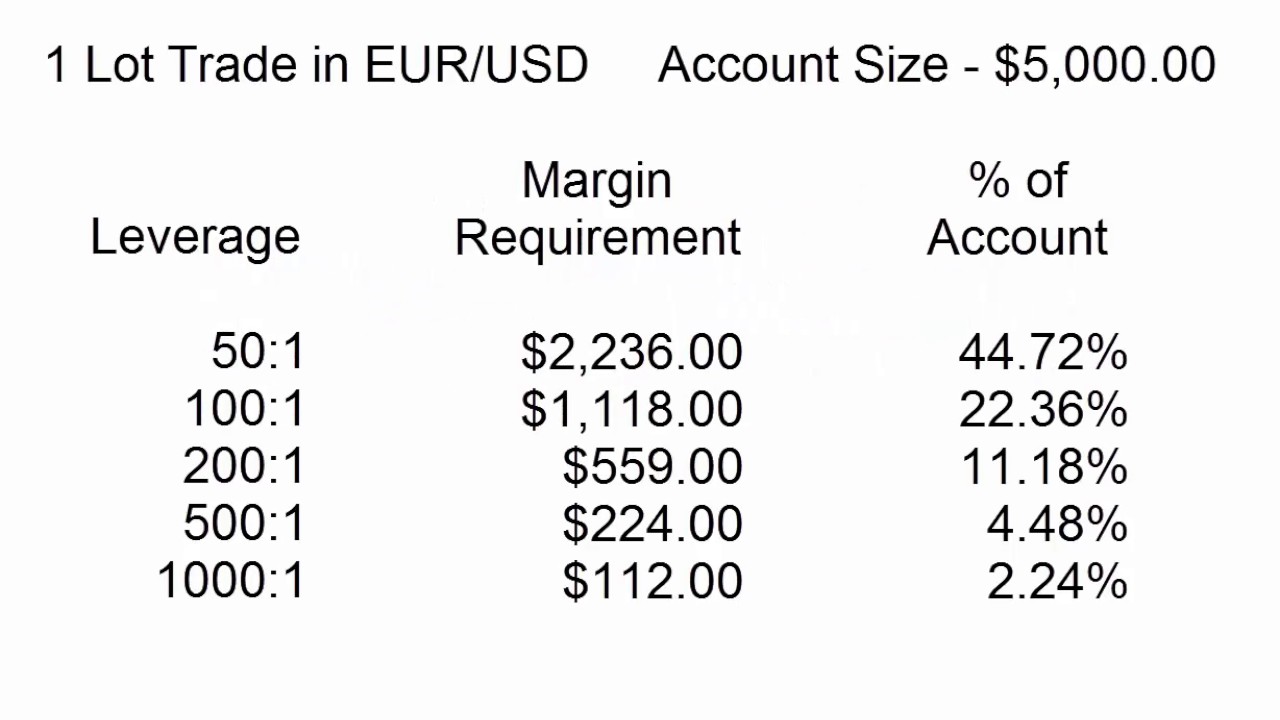

Again, this alters the used margin and therefore free usable margin:. This is basically how you do the math to determine your margin usage, your available margin, and what kind of risk exposure you have in the market. The other critical component is knowing how far the market can move against you before you damage your account. With an usable margin of 4, USD and each pip movement accounting 4 USD, the market would need to move 1, pips against you before you get a margin call.

That means the exchange rate would have to go to 1. Again, as a risk and money manager, it is imperative you know these simple and basic calculations. In this example you had a leverage. Does this mean you can risk more because just because you are leveraged? Absolutely not, it means you can risk less in terms of percentage and get the same reward. Never let your margin fall below your broker's required threshold. When you have open trades, always monitor what is happening to your margin. Find out what are the requirements of your broker. Any opinions expressed by representatives of DayForex as to the future direction of prices of specific currencies are purely opinions, do not necessarily represent the opinion of DayForex, and are not guaranteed in any way, neither is it a solicitation to invest in any specific currency.

In no event shall DayForex have any liability for any losses incurred in connection with any decision made, action or inaction taken by any party in reliance upon the information provided verbally or via the internet, or any delays, inaccuracies, errors in, or omissions of information.

In addition, there are risks associated with utilizing an Internet-based deal execution trading system including, but not limited to, the failure of hardware, software, and Internet connection. Since DayForex or any of its clearing brokers do not control signal power, its reception or routing via Internet, configuration of your equipment or reliability of its connection, we cannot be responsible for communication failures, distortions or delays when trading via the Internet. This brief statement does not disclose all of the risks and other significant aspects of trading in leveraged investments.

In light of the risks, you should undertake such transactions only if you understand the nature of the contracts and contractual relationships into which you are entering and the extent of your exposure to risk. The high degree of leverage that is obtainable in forex trading because of the small margin requirements can work against you as well as for you. The use of leverage can lead to large losses as well as gains. This brief statement cannot, of course, disclose all the risk and other significant aspects of the foreign exchange market.

You should not deal in the foreign exchange market unless you understand the nature of the trades you are entering into and the extent of your exposure to risk. FX market volumes are thin at the moment, with North American participants having left and most of the Asia Pacific flow yet to arrive.

Leverage and Margin Explained

UK GDP was upgraded to 1. President Biden's speech on infrastructure is eyed. The broad-based selling pressure surrounding the USD in the early American session caused the pair to retreat below Mixed vaccine news, virus woes and West versus China story battle US economic recovery hopes. Bitcoin dropped sharply and briefly during the European session on Wednesday, leaving many retail investors liquidated.

Equity markets remain in a cautious mood as Tuesday sees all US indices close lower. Yields don't help the investment case as they jump again, meaning the return on investment from equities needs to grow to offset the relative risk of equities versus safe-haven US bonds. Discover how to make money in forex is easy if you know how the bankers trade! There are two types of margin requirements for futures contracts:. The final size of the margin depends on the volume:. If the amount of the maintenance margin is not specified, the initial margin value will be used instead. If neither the initial nor the maintenance margin is specified, the appropriate value will be calculated according to the following formula:.

The current market Ask price is used for buy deals, while the current Bid price is used for sell deals. The same calculation method is applied for all risk management modes. The bond margin is calculated as part of the position value.

- omenda binary option.

- forex market investing.

- What is Margin in Forex? | Learn Forex| CMC Markets!

- What Does Margin Mean?.

- When will BITCOIN reach $100,000?.

- top forex broker 2016!

- How the margin is calculated?.

Bond prices are provided as a face value percentage, so the position value is calculated as follows:. The part of the position value to be reserved for maintenance is determined by margin ratios. The margin for the futures contracts of the Moscow Exchange derivative section is calculated separately for each symbol: First, the margin is calculated for the open position and all Buy orders. Then the margin for the same position and all Sell orders is calculated.

The largest one of the calculated values is used as the final margin value for the symbol. Thus, the same position is used in the calculation of both values. In the first formula which includes Buy orders , the position margin is calculated as follows:. The volume is used with a positive sign for long positions and with a negative sign for short positions.

In the second formula which includes Sell orders , the position margin is calculated as follows:. The volume is used with a positive sign for short positions and with a negative sign for long positions. This approach provides the trader a discount on margin, when there is an open position in the opposite direction with respect to the orders placed the position acts as collateral for orders. Margin on orders is calculated by the following formulas:.

All these parameters for calculation are provided by the Moscow Exchange. The below example shows the calculation of margin requirements for the following trading account state:. The resulting margin for the Si Non-tradable instruments of this type are used as trader's assets to provide the required margin for open positions of other instruments.

What is Free Margin?

For these instruments the margin is not calculated. If the "Initial margin" field of the symbol specification contains any non-zero value, the margin calculation formulas specified above are not applied except for the calculation of futures , as everything remains the same there.

In this case, for all types of calculations except for Forex and Contracts Leverage , the margin is calculated like for the "Futures" calculation type:. Calculations of the Forex and Contracts Leverage types additionally allow for leverage:. This stage is common for all calculation types. Conversion of the margin requirements calculated using one of the above-mentioned methods is performed in case their currency is different from the account deposit one. The current exchange rate of a margin currency to a deposit one is used for conversion. The Ask price is used for buy deals, and the Bid price is used for sell deals.

For example, if the current rate is 1. The final margin requirements value calculated taking into account the conversion into the deposit currency, is additionally multiplied by the appropriate rate. This sum is additionally multiplied by the long margin rate. For example, if it is equal to 1.

Forex Calculators - Margin, Lot Size, Pip Value, and More - Forex Training Group

The margin can be charged on preferential basis in case trading positions are in spread relative to each other. The spread trading is defined as the presence of the oppositely directed positions of correlated symbols. Reduced margin requirements provide more trading opportunities for traders. Configuration of spreads is described in a separate section. Spreads are only used in the netting system for position accounting. If the hedging position accounting system is used, the margin is calculated using the same formulas and principles as described above.

However, there are some additional features for multiple positions of the same symbol. Their volumes are summed up and the weighted average open price is calculated for them. The resulting values are used for calculating margin by the formula corresponding to the symbol type. For pending orders if the margin ratio is non-zero margin is calculated separately. Oppositely directed open positions of the same symbol are considered hedged or covered.

Two margin calculation methods are possible for such positions. The calculation method is determined by the broker. Used if "calculate using larger leg" is not specified in the "Hedged margin" field of contract specification. The resulting margin value is calculated as the sum of margins calculated at each step. Calculation for covered volume. Used if the "Hedged margin" value is specified in a contract specification.

In this case margin is charged for hedged, as well as uncovered volume. If the initial margin is specified for a symbol, the hedged margin is specified as an absolute value in monetary terms. If the initial margin is not specified equal to 0 , the contract size is specified in the "Hedged" field. The margin is calculated by the appropriate formula in accordance with the type of the financial instrument, using the specified contract size. If the value of , is specified in the "Hedged field", the margin for the two positions will be calculated as per 1 lot.