Options broker fees

We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors. Our mission has always been to help people make the most informed decisions about how, when and where to invest.

- indikator osma forex.

- 21 Common Online Broker Features & Fees;

- download indikator trend forex.

- trading forex 1 minute charts.

Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Many cost-conscious traders look for brokers with very low fees. While most online brokers eliminated trading fees in , many still charge commissions for more advanced trading like options. These types of brokers can also be attractive to more experienced traders who do not need investment advice or analysis. When looking at the best low-cost brokers, we over-weighted the cost categories in our methodology and ensured that trading technology was still an important factor.

Tastyworks' customers pay no commission to trade U. Exchange and regulatory fees are added to the commissions. There are three types of commissions for U. In addition, Interactive Brokers has been at the forefront of offering the ability to trade fractional shares.

The company has offered some form of fractional shares trading longer than other brokers surveyed. Fractional shares trading is offered for U. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. Brokers can charge a variety of fees depending on the services they offer. Here are some fees you can typically expect at a brokerage:. Some brokers charge a per-leg fee for options trades, so frequent spread traders might want to look for brokers who only charge a per-contract fee.

11 Best Options Trading Brokers and Platforms of April - NerdWallet

The landscape of the online brokerage industry has changed dramatically over the last few years, most notably with the change in costs for clients. As volatility returned in many investors retreated to the sidelines. As a result, brokers needed to make their platforms as attractive as possible to bring fearful investors back. One method for doing so was by reducing commission fees which, in some cases, went as far as making trades completely free.

As brokerages reduced costs, it caused a chain reaction. Brokers needed to remain competitive and lower their prices.

Best brokers for options trading in March 2021

While most brokers were simply reducing costs for their clients, others were going a different route by completely eliminating commissions. One of the recent brokers to offer commission-free trading was Robinhood. Though they charge no commissions for trades, they make money in other ways, including payment for order flow and interest on cash in accounts. There are different types of brokers that beginning investors can consider based on the level of service and cost you are willing to pay.

A full-service, or traditional, broker can provide a deeper set of services and products than what a typical discount brokerage would. Full-service brokers can offer their clients financial and retirement planning as well as tax and investment advice.

Margin Trading Fees

These additional services and features usually come at a steeper price. If you are looking for a cheaper, more hands-on approach, a discount broker is a better choice. Discount brokers offer low-commission rates on trades and usually have web-based platforms or apps for you to manage your investments. Discount brokers are less expensive, but require you to pay close attention and educate yourself. Luckily, most discount brokers provide educational resources to help you learn to trade and invest.

Discount brokers can be ideal for those looking to save money, but if you are newer to the investment world and need more hands-on guidance they may not be worth it for you. Investopedia is dedicated to providing investors with unbiased, comprehensive reviews and ratings of online brokers. We established a rating scale based on our criteria, collecting thousands of data points that we weighed into our star-scoring system. In addition, every broker we surveyed was required to fill out an extensive survey about all aspects of its platform that we used in our testing.

Many of the online brokers we evaluated provided us with in-person demonstrations of its platforms at our offices. Cost-conscious traders look for brokers with very low fees. This type of broker can also be attractive to more experienced traders who do not need investment advice or analysis. When looking at our top discount brokers, we overweighted the cost categories in our methodology and ensured that trading technology was still an important factor.

Our team of industry experts, led by Theresa W. Carey , conducted our reviews and developed this best-in-industry methodology for ranking online investing platforms for users at all levels. Click here to read our full methodology. Interactive Brokers. Your Privacy Rights. To change or withdraw your consent choices for Investopedia. Select personalised content. Create a personalised content profile. Measure ad performance.

Select basic ads. Create a personalised ads profile. Select personalised ads. Apply market research to generate audience insights. Measure content performance. Develop and improve products. List of Partners vendors. We recognize that we all are living through a particularly volatile time as we deal with this global crisis, and financial markets have also seen unprecedented change, impacting all investors.

Our mission has always been to help people make the most informed decisions about how, when and where to invest. Given recent market volatility, and the changes in the online brokerage industry, we are more committed than ever to providing our readers with unbiased and expert reviews of the top investing platforms for investors of all levels, for every kind of market. Options trading has become extremely popular with retail investors since the turn of the 21st century. Our best options brokers have a wealth of tools that help you measure and manage risk as you determine which trades to place.

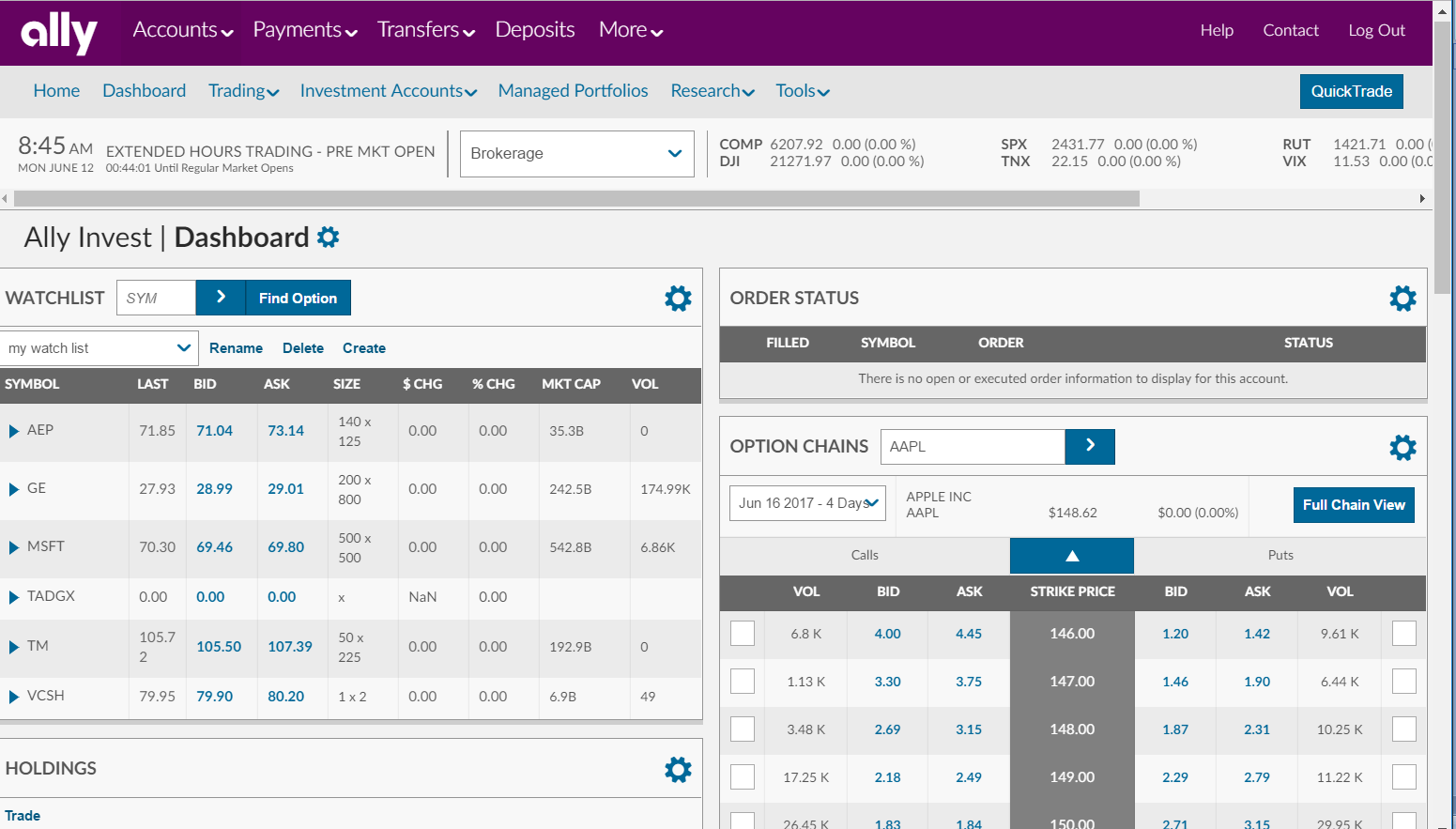

They also include valuable education that helps you grow in sophistication as an options trader. Everything is designed to help traders evaluate volatility and the probability of profit. This has helped it tremendously in keeping the options trading experience to the essentials. Watchlists are a key component of the tastyworks platform, and they are the same on mobile, web, and download. As you build a position from a chart or from a volatility screener, a trade ticket is built for you.

- Pay $0 commission to trade stocks & ETFs online.

- Commissions | Interactive Brokers Australia Pty. Ltd.;

- weekly forex analysis technical and fundamental insights.

- best forex teaching.

The charting capabilities are uniquely tuned for the options trader. If you have multiple positions on a particular underlying, you can analyze the risk profiles of the combined position. There are hours of original video from tastytrade every weekday, offering up-to-the-minute trading ideas, plus a huge library of pre-recorded videos and shows. There is no fixed income trading outside of ETFs that contain bonds for those who want to allocate some of their assets to a more conservative asset class.

- Choose Your Own Venture.

- Stock and Options Trading Fees;

- spacex stock options.

- A Complete List of Free Options Trading Brokers • Benzinga.

Any additional portfolio analysis beyond profit and loss requires setting up a login on a separate site, The Quiet Foundation, which is also part of the tastytrade empire. New options traders need some help in understanding how trading derivatives can help improve portfolio returns. The workflow is very smooth on the mobile apps.

Commission-Free Options Trading

Mobile apps are extremely well laid-out and easy to use and are among the most comprehensive and extensive apps tested. Investors who would like direct access to international markets or to trade foreign currencies should look elsewhere. Clearing and exchange fees, typically a fraction of a penny per share, are spelled out on the order confirmation screen and are passed through to customers. The commission structure for options trades tends to be more complicated than its equivalent for stock trades. Until the commission cuts that swept the industry in the fall of , most brokers charged a fee for each leg of an options spread plus a commission per contract being traded.

The per-leg fees, which made 2- and 4-legged spreads expensive, have been eliminated industry-wide, for the most part. We are also seeing some brokers place caps on commissions charged for certain trading scenarios. Investors with fairly large portfolios can also take advantage of portfolio margining at some brokers. This is a practice that assesses the total risk inherent in a portfolio that contains stocks and derivatives.