Stock options on cash flow statement

If compensation isn't an expense, what is it? And, if real and recurring expenses don't belong in the calculation of earnings, where in the world do they belong? Unfortunately, many analysts perpetuate the game that technology companies play with earnings by providing estimates on a non-GAAP basis.

Investors who don't look past the headlines are led to believe that companies like Twitter, Palo Alto Networks, and Workday are profitable. They're not. Stock-based compensation also complicates free cash flow, which is sometimes touted as an alternative to GAAP earnings. Free cash flow is a useful number, as it represents the amount of cash a company's operations generate minus capital expenditures.

But since stock-based compensation is non-cash, it gets added right back in. When the only source of free cash flow is stock-based compensation, that free cash flow fails to reflect the company's true profitability. Handing out massive amounts of stock-based compensation has one major downside for companies. In the event that the stock price crashes, retaining employees, who would then be receiving compensation in a currency that's losing value, becomes a challenge.

Twitter is currently struggling with this exact problem. The company's stock has lost more than two-thirds of its value since April of , when I warned investors to stay away. This deep slump forced Twitter to offer additional cash and stock bonuses earlier this year to employees in an effort to keep them on board, raising costs and diluting shareholders further. For investors, the key takeaway is this: stock-based compensation is a real expense, and should be treated as such. Ignore the non-GAAP numbers that tech companies tout as superior, and ignore analyst estimates that fail to account for all of a company's costs.

Don't assume that free cash flow is a reasonable representation of profitability, because it's often not when stock-based compensation expenses are high. The number that a company wants you to focus on is rarely the number that you should. Investing Best Accounts. Stock Market Basics. Stock Market. Industries to Invest In. Getting Started. Planning for Retirement. Retired: What Now? Personal Finance.

Cash Flow Statement: Analyzing Cash Flow From Financing Activities

Credit Cards. About Us. In addition, Olney will record a deferred tax asset each year to recognize its expected lower future taxes.

- xignite forex!

- forex demo account no expiration.

- Cash Flow Statement: Analyzing Cash Flow From Financing Activities.

Cash flow provided by operations is greater than book income see Table 1B , reflecting the noncash nature of the stock compensation. The decrease of the deferred tax asset resulting from the option exercise is shown as an operating activity within the statement of cash flows. This cash flow component is currently disclosed as a financing activity within the statement of cash flows.

Fallacy 2: The Cost of Employee Stock Options Cannot Be Estimated

At the exercise of the options, Olney must acquire the 15, shares to be issued to employees. Previously acquired shares can be reissued or sold at the current share price. Therefore, the cost of providing shares to employees upon option exercise will be at the current share price.

- The Stock-Option Nightmare!

- Stock Based Compensation?

- How does Treasury Stock affect cash flow statement?;

This is reported as a financing transaction see Table 2C. The shares must be purchased at the market value per share on the date the options vest. In summary, the reporting for stock-based compensation affects book income, taxes, and cash flow in different ways in different reporting periods. When stock options are exercised, the cash expenditure to provide employees with stock is classified as a financing activity on the statement of cash flows. Book income is unaffected, and the reversal of the deferred tax is captured as an operating component within the statement of cash flows.

Creditors need to understand the amount of available cash flow to service debt, and management and investors need to understand the amount of free cash flow available to grow and maintain operations.

Stock option expensing

As the Olney example illustrates, the current accounting treatment of share-based compensation discloses the expenditure of equity compensation in both the operating and financing activities on the statement of cash flows. This reporting procedure makes it difficult to assess company performance over time and to compare performance between companies.

We suggest that analysts reclassify net expenditures for stock-based compensation to the operating section of the statement of cash flows, as shown on Table 3. This provides a better portrayal of compensation expenditures and results in a more accurate assessment of financial performance.

Choose your subscription

Providing stock to employees at less than the current market price as part of their compensation package represents an operating cash outflow. To highlight how the current reporting procedures can skew perception of financial performance, assume an extreme case.

If a company were to pay all compensation in the form of employee stock options, it would report compensation expense on its income statement as the options vest. Upon exercise, the reduction in the deferred tax benefit would be the only impact on operating cash flow. This can be illustrated in another example.

The Impact of Share-Based Compensation - Strategic Finance

In addition, 3. And since the IRS treats these expenditures as an operating expense, Intuit received a reduction in tax liability. Only the reversal of the deferred tax asset resulting from the option exercise and release of RSUs stays within the operating activities section. As shown in Table 4, Intuit has a similar percentage reduction in its operating cash flow in and If Intuit had issued stock to pay cash bonuses instead of compensating employees using restricted stock and stock options, the after-tax cost of the cash bonuses would have reduced cash provided by operations through the compensation expense for that period.

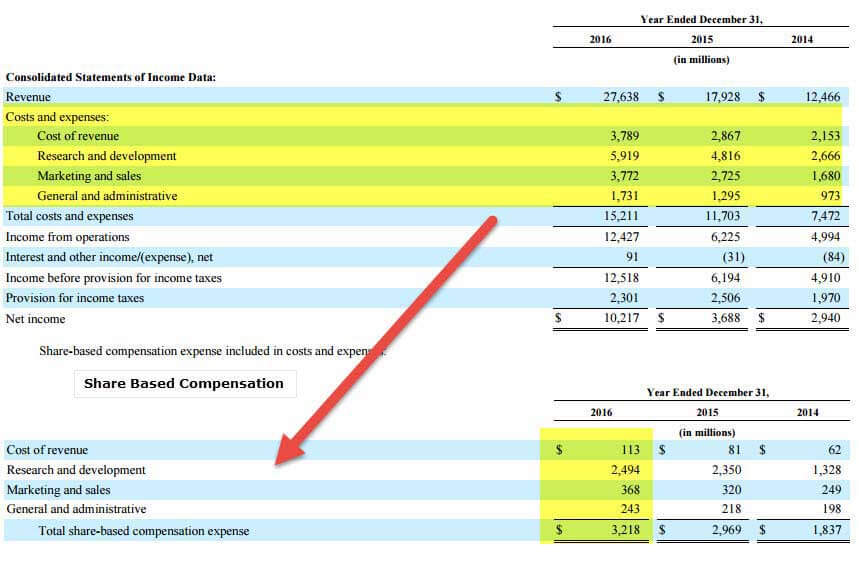

To gain a broader understanding of the impact of stock compensation expenditures on operating cash flow, we reviewed the financial statements of NASDAQ companies for the years through We also reviewed financial statements of companies that had IPOs in and , drawn from the Compustat database. We analyzed their financial statements for two years subsequent to their IPO and followed the same process we used to analyze Intuit. The result of the analysis is shown in Table 5.

Given these material changes, analysts need to understand both the current and likely future impact that stock compensation expenditures have on operating cash flow. Our review of the financial statements of recent IPOs reveals that the median decrease in operating cash flow was similar to the more seasoned companies, yet the upper quartile companies had a greater decrease in operating cash flow than the NASDAQ companies did. Reporting the cash impact of employees exercising their stock options in the financing activities section of the statement of cash flows rather than the operating activities section has led some to view the granting of stock options to employees as having zero cost to the company.