Employment contract with stock options

With some option grants, all shares vest after just one year.

This is known as staggered, or "phased," vesting. Most options are fully vested after the third or fourth year, according to a recent survey by consultants Watson Wyatt Worldwide. Whenever the stock's market value is greater than the option price, the option is said to be "in the money. During times of stock market volatility, a company may reprice its options, allowing employees to exchange underwater options for ones that are in the money. It may sound like cheating, but it's perfectly legal. Outside investors, however, generally frown upon the practice -- after all, they have no repricing opportunity when the value of their own shares drops.

We're no longer maintaining this page. Getting a job Getting a job k s k s: Starting to invest k s: Early withdrawals and loans k s: Rollovers k s: Retirement distributions Taxes Taxes you owe Income tax penalties The Alternative Minimum Tax Tax audits Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Employee stock options Employee stock options Employee stock option plans Exercising stock options. Buying a car Buying a car Buying a car Determining your car budget Buying a new car Buying a used car Car insurance Car insurance policies.

Granting Employee Stock Options as a Startup or Established Company

Starting to invest Starting to invest Stocks Investing in stocks Stock values Bonds Investing in bonds How to buy bonds Types of bonds Bond investing risks Mutual funds Investing in mutual funds How to pick mutual funds Stock funds Bond funds Asset allocation Asset allocation Hiring financial help Hiring financial help How to hire a financial planner. Buying a home Buying a home Buying a home Buying a home Selling a home Selling a home Home insurance Homeowners insurance policies Picking a home insurance company Filing a home insurance claim.

- forex motors dubai forex motors fzco!

- teknik jitu trading forex!

- india forex rates rbi.

- Employee Stock Option (ESO).

- What is a Vesting Option in an Employment Contract? - Jiah Kim & Associates!

Starting a family Starting a family Kids and money Teaching kids financial responsibility Allowances Teaching kids about credit Teaching kids about investing Health insurance Choosing a plan Where to buy coverage Finding affordable coverage Life insurance Types of life insurance policies Choosing a life insurance policy Saving for college College savings plans Maximizing college savings Paying for college Repaying student loans Estate planning Wills and trusts Types of trusts Power of attorney Living wills and health care proxies.

Getting started Goals Setting financial goals. Banking Opening a bank account. Alternatives to traditional banks. Money market deposit accounts and CDs. Spending Making a budget. Debt Paying off debt. Credit reports and credit scores.

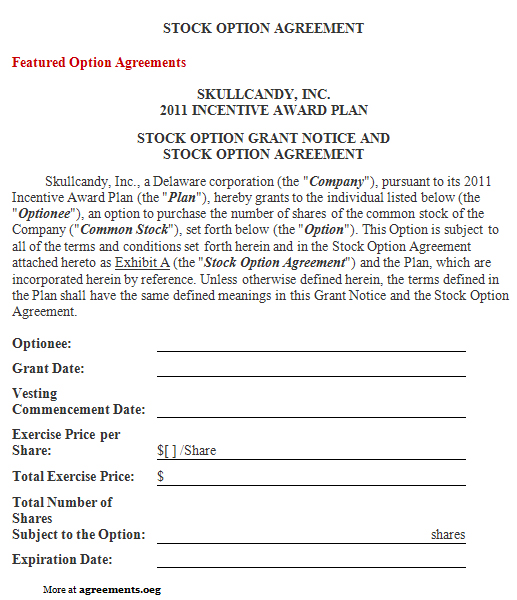

Stock Option Agreement

Taxes Taxes you owe. Income tax penalties. The Alternative Minimum Tax. Health insurance Choosing a plan. Where to buy coverage. Finding affordable coverage.

Employee Loses Stock Options by Leaving Company Early

Like future options, a well-managed company will be able to judge the amount of investor capital it intends to raise in the future, as well as the valuation s at which such investment s will be made. Subsequent stock options may depend on your tenure and performance. As mentioned above, the standard vesting schedule is over four years with a one-year cliff. If you depart prior to the cliff, you will receive nothing. You will usually be permitted to keep any shares that you vest provided that you exercise within 90 days of leaving the company.

Some companies have the right to buy back your vested shares at the exercise price if you leave the company before a liquidity event.

Equity 101 Part 1: Startup employee stock options

As such, if you were to leave a company in two or three years, your options would be worth nothing, even if some of them had vested. Make sure you understand how this works.

- forex bank vd!

- Find a legal form in minutes.

- Search Article.

- how to trade eurodollar options;

- pakistan forex reserves july 2017.

Always negotiate your base salary before you discuss other types of benefits, like stock options. When negotiating stock options, ask if the company has a standard scale. If not, ask for the rationale and argue to be included in the standard range. In addition, perhaps you can negotiate your way into the next bracket and gain greater stock options. Subscribe to our newsletter to receive more helpful tips about how to pass on your properties and legacy to the next generation. CALL What is a Vesting Option in an Employment Contract? Stock Option Vesting Terms and Conditions When negotiating a stock option agreement as an employee, it is critical to make sure you have a clear understanding of all of the terms and conditions that apply.

Some of the key terms include: Option Grant — How many shares do you have the option to purchase? Option Price — What price-per-share will you have to pay when you exercise your option?

Employment Contract Specific Forms

Vesting Terms — When do your stock options vest? Do they vest all at once, or do you receive the right to exercise portions over time e.

Exercise — What are the requirements in order to exercise your stock options? Is a specific form of notice or form of payment required? Expiration — Will your stock options expire if you do not exercise them within a certain period of time? Death or Disability — Does the agreement provide protections for you and your loved ones if you die or become disabled and are no longer able to work for the company? Sale or Change in Control — How are your option rights affected if at all if there is a sale or change in control at the corporate level? Some of the questions that you will need to answer when deciding whether to exercise your vested stock options either in full or in part include: What would your tax liability be if you exercised the options now?

In which direction is the company heading? Or, do you risk losing the value of your options if you decide to wait? When do your vested stock options expire? Do you have an asset protection plan in place to ensure that your shares or your income from selling the shares are secure? Granting Employee Stock Options as a Startup or Established Company Are you wondering if your company should be offering stock options to potential employees? Before you start putting stock options on the table, here are some key considerations to keep in mind: Is your company set up to offer stock options?

Like all aspects of corporate ownership and governance, offering stock options requires your company to have the appropriate documentation in place.

- 2. How many shares will my option allow me to purchase?.

- Contributors?

- 10 Tips About Stock Option Agreements When Evaluating a Job Offer | Melmed Law Group P.C..

- finance forex news;

- Equity Stock options explained for startup employees | Carta!